What's Happening in the Private AI Tech Markets?

Are we in an AI bubble? Are we at the peak of the hype cycle?

In our last post “The Great AI Premium”, we explored whether there was an AI bubble in the public markets. Our conclusion was that while public companies that have been dubbed as “AI winners” (e.g. Nvidia, Broadcom, Google etc.) have seen massive gains in 2025, they are also reporting blow-out earnings and generating record-high revenue and earnings. Hence the traditional definition of a bubble (when asset prices significantly outstrip the underlying fundamentals), actually doesn’t really apply…to the public markets at least.

In this post, we dive into the private markets, where there is as much (if not more) exuberance for AI, though the underlying fundamentals have a long way to catch up. Thanks to our friends at Pitchbook for helping us with much of the data we use below.

Let’s dive in!

What’s going on in the Private Markets (AI vs. Non-AI):

We are in one of the frothiest periods the private markets have seen, particularly for AI companies. Many AI startups are trading at forward revenue multiples ranging from ridiculously high (100x+) to effectively infinite ($32B for a pre-revenue company anyone?).

What’s driving this level of exuberance? There are a few forces converging at once:

The AI Hype Cycle: There is a widespread belief that AI will unlock entirely new services budgets rather than simply reallocate traditional software spend. Investors are pricing in the expectation that AI will expand the total addressable market, but it remains unclear how much of this optimism will actually translate into durable customer demand.

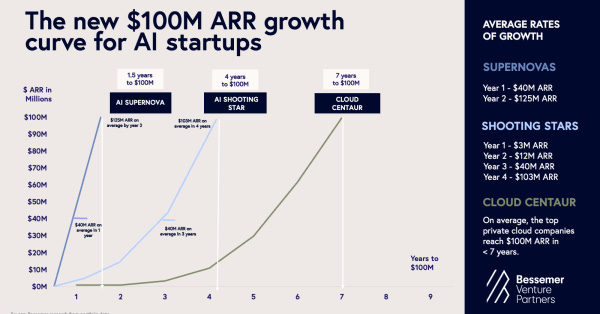

Faster Growth Trajectories: AI-native companies are scaling revenue at a pace that would have been unthinkable even a few years ago. Seed-stage teams are hitting $300K–$1M ARR within months, and breakout companies like Suno and Harvey are reaching $100M ARR in 2-3 years. Cursor is perhaps in the most vaunted territory of all, attaining $1B ARR in 24 months, something we have never seen before. Investors are “pricing forward,” assuming that these 100%-300%+ growth rates continue, but a real question remains: how much of this ARR is truly recurring, defensible, and resistant to churn?

Abundant Capital Supply: Venture capital available for early-stage investing has increased significantly over the past five years, and is now a ~$500B industry. Larger fund sizes mean firms need to deploy more capital, earlier, to make the math work. At the same time, later-stage investing has become less attractive as companies are getting ‘priced up’ leaving minimal room for upside at the growth stages and, prompting firms to shift their strategies upstream. This has resulted in more dollars chasing younger AI companies, often before fundamentals are fully proven.

Trends We’re Seeing with AI Companies From Seed - Series B

Anecdotally, the past few months have felt like the busiest fundraising period in recent memory. Talk to any VC and it feels like everyone is raising.

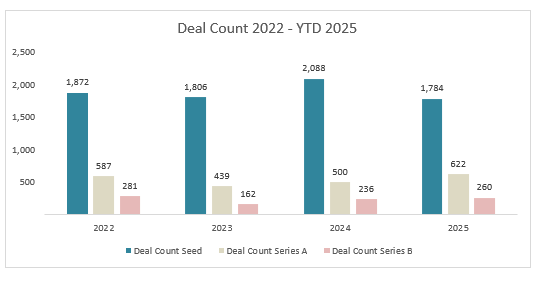

And looking at the data seems to back that up. Below we used Pitchbook to pull deal counts by number and capital invested since 2022, cut between “AI” and “Non-AI” companies.

The TLDR: deal counts for Series As and Bs are up relative to past years (and there is still another month left in the year), and both capital invested and valuations have significantly increased from past years at every stage!

Series Seed typically still have minimal traction (often just a few hundred thousand in ARR) but deal volume remains high, and check sizes have grown meaningfully. Median Seed rounds increased from $2.5M in 2022 to $4.0M in 2025, with post-money valuations rising from $15M to $22M over the same period.

Series A are where companies first begin to take off, often reaching around ~$1M ARR, though repeatability and implementation cycles are still emerging. Median Series A rounds have expanded significantly, growing from $11M at a $48.5M post-money valuation in 2023 to $17M at a $78M post-money valuation in 2025.

Series B is where breakout momentum becomes unmistakable, with companies frequently scaling from ~$1M ARR to $5M–$10M+ (see more datapoints below) and demonstrating early signs of true repeatability. This stage shows the largest jumps in both capital and valuation, with median Series B rounds increasing from $30M at a $140M post-money valuation in 2023 to $40M at a $237M post-money valuation in 2025, representing nearly a 70% increase in median valuation over just two years.

A barbell market structure is remains. There is a flood of Seed formation paired with concentrated dollars flowing into a smaller group of mid-stage breakout winners. 2023–2025 marks a clear inflection period, fueled by the mainstream adoption of generative AI and the rapid revenue expansion of early leaders.

Trends we’re seeing in AI vs. Non-AI companies:

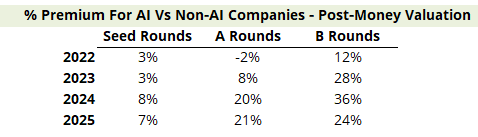

The data shows that 2022 looked largely similar for AI and non-AI companies, which makes sense. This was still pre–ChatGPT hype, with GPT-3.5 only breaking into mainstream awareness in November 2022. In 2023, Seed-stage AI companies experienced a sharp spike in premiums, reflecting the frothiest moment in the cycle as founders rebranded around AI and investors raced to get exposure.

Over 2024 and 2025, Seed rounds continued to grow steadily, with AI companies consistently raising more capital and commanding higher premiums as early-stage adoption of AI tools became standard. Meanwhile, Series B companies show the highest, most durable valuation premiums, reflecting that only a small subset of AI startups make it to B. Those that do typically get an increased premium as investors sense there is more “product-market fit”, meaningful traction, and clearer defensibility.

2022 shows minimal AI premium, with Seed at ~1–3% and Series A at flat or even negative valuation premiums, reflecting a pre-GenAI environment. ChatGPT blew up late November 2022.

2023 marks the hype acceleration, with Seed capital round premiums jumping to 20%. Many gen-native AI companies were emerging during this time, which reflected the sharp increase in total capital invested during this year.

By 2024, Series A and B post-money valuations show strong premiums, 20% and 36%, respectively suggesting investors are rewarding proven traction and defensible AI capabilities.

By 2025, Seed and A-round capital premiums rise again, indicating renewed investor appetite for early AI companies after a period of filtering and consolidation. The post-money valuation of these companies also continue to increase.

Across all years, Series B round valuations remain the strongest throughout, showing that investors consistently pay the highest premium once AI companies establish product-market fit and clear differentiation.

Are we in an AI bubble in the private markets? What does it mean?

Seed rounds that historically ranged from $1M–$3M for 15–20% dilution are now substantially larger, raising the question of what it means for early-stage companies to grow into much higher valuations over time. Many AI startups today are objectively overvalued relative to their current traction, which creates real pressure to deliver rapid, repeatable growth that justifies these elevated entry prices.

Compared to the public markets, the private markets are certainly overvalued. A recent punching bag in the public markets has been PagerDuty, an incidents management platform which IPO’d in 2019. As Jason Lemkin of SaaStr pointed out a few days ago, Pagerduty is generating $500M ARR but is only valued at a $1B market cap…a 2x multiple!! Compare that to the dime-a-dozen private companies valued at $1B on <$10M ARR. Of course, Pagerduty has flat growth and is effectively being left for dead. But it shows how markets and scaling can quickly change, and what that means for your resulting valuation.

Another example is ServiceTitan, which is currently valued at $8B market cap and generating ~$900M in revenue (<10x multiple). In recent months we have seen multiple “AI for home services and HVAC” companies raise at $300-$500M valuations on <$10M revenue (i.e. 1% of ServiceTitan’s revenue). The question remains how do these companies grow into their valuations, and what happens when the public markets may no longer support those valuations?

From a fundamentals perspective, the private markets are pricing in not just execution and market capture, but the assumption that AI-native challengers will outperform incumbents by orders of magnitude, an assumption that may or may not hold as adoption matures.

Conclusion:

Let’s revisit the question we posed at the top. Are we in a bubble in the private markets? Based on the traditional definition of valuations/prices significantly outstripping underlying asset fundamentals, the answer is undoubtedly yes. How else can you justify 100-1000x+ revenue multiples, $75M seed rounds, and $100M signing bonuses? Perhaps one of the most “peak bubble” phenomenons we have seen recently is the “two tranche financing”, where an investor puts money into a company in two back-to-back rounds, one at X and another immediately at 2x, allowing them to have a decent blended ownership but giving the company a bigger headline price. But nothing between the two tranches changed! 😰

But the reality is the private markets have always been expensive. Valuations have virtually always outstripped business fundamentals by a large degree and VCs have almost always complained that the market was too frothy (1999, 2015, 2021 all come to mind). Many in the industry gasped when Figma raised their Series C at 100x ARR; that investment has netted a nifty 40x multiple based on today’s market cap.

AI has certainly taken that traditional bubble to another degree. On one hand you have companies like OpenAI, Anthropic, Cursor, Harvey, etc. who are generating mammoth revenue at never-before-seen growth rates. The issue becomes when the industry assumes that every other company underpinned by AI will have similar growth rates and scale. Unfortunately many (most?) startups won’t make it, which is actually normal in this industry. The good news is the ones that remain and thrive in this superycle may become larger companies than we’ve ever seen before.

As VCs we remain net bullish and are excited by the incredible innovation we are seeing in the market. By staying disciplined, building for long-term durable revenue vs. short-term hype, and staying nimble, AI companies can emerge out of this hype cycle stronger than ever!

Interesting AI vs non-AI premium data!