What Are We Seeing As VCs - Summer 2024 Edition ☀️

Is the AI hype train still charging ahead?

Please subscribe, and share the love with your friends and colleagues who want to stay up to date on the latest in artificial intelligence and generative apps!🙏🤖

In June 2023 we published a post highlighting some of the key trends in the AI ecosystem that we were seeing as VCs. Since then, many would argue that the ‘froth’ within the AI ecosystem has died down (or as a recent Inc. article claimed, the “AI Hype Machine is Running on Empty”). but that doesn’t mean the total dollars raised have. As VCs, we see a juxtaposition: a handful of impressive companies continue to raise exuberant rounds well above public market valuations, yet many GenAI startups struggle to find their product-market fit.

We thought it was a good time to refresh our views on the AI startup landscape and take a data-driven approach to understand the fundraising market for GenAI (more on the use of that term below), where we see early signs of successes and difficulties, and lessons learned.

Read on for more fun charts below!

How Has the Fundraising Environment Changed for GenAI?

Below is a breakdown from Pitchbook highlighting the total capital invested and number of deals funded across GenAI in the last 10 quarters. Clearly, there has been no shortage of activity!

Some observations:

Q1’23 was the first quarter after ChatGPT was released in November 2022, which unleashed a surge of interest from VCs and founders in GenAI (and much of this quarter’s funding went to OpenAI itself). We didn’t see the same amount of $$ activity for the next four quarters.

This past quarter (Q2’24) saw the highest amount of dollars invested in the category on record, a 300% increase YoY.

Interestingly - while the total investment dollars increased significantly, the number of deals completed in Q2 ‘23 was relatively in line with the number of deals completed in Q2 '24.

Essentially there were several megadeals announced which meaningfully drove up the total dollars invested. These megadeals included: xAI which raised $6B; Coreweave which raised $8.6B; ScaleAI which raised a $1B round; and Mistral which raised $650M.

Although overall capital invested increased earlier this year, when we cut the data to look at US pre-seed and seed deals specifically, we actually see a sharp decline in both deal value and deal count:

We believe this is primarily driven by the following:

Many early-stage VCs invested capital across a variety of pre-seed and seed-stage GenAI companies in 2023 and are now waiting to see how these companies perform.

Over the past year, several “Gen-enhanced” companies (e.g. Canva, Notion, Zapier) added advanced GenAI features into their products, making it harder for newer challengers to enter and get off the ground.

A narrowing scope for new entrants in determining what they should build. A year ago, we saw many startups formed around building a new foundation model. Now that is no longer the case for NEW entrants.

Pursuant to the last bullet above, we are seeing venture dollars continue to flow to foundation model companies - just more $$ to already large platforms.

Over $7B poured into foundation model megadeals this year alone, with over $5b being made up by LLM providers like Anthropic, Mistral AI, and xAI.

Foundation models continue to require a lot of investment capital, but the good news for startups is they no longer have to invest money building this layer o the stack. The tremendous leaps in open-source models and the falling costs of AI is making it easier for startups to build a next-gen application.

So What Are We Seeing as AI Investors?

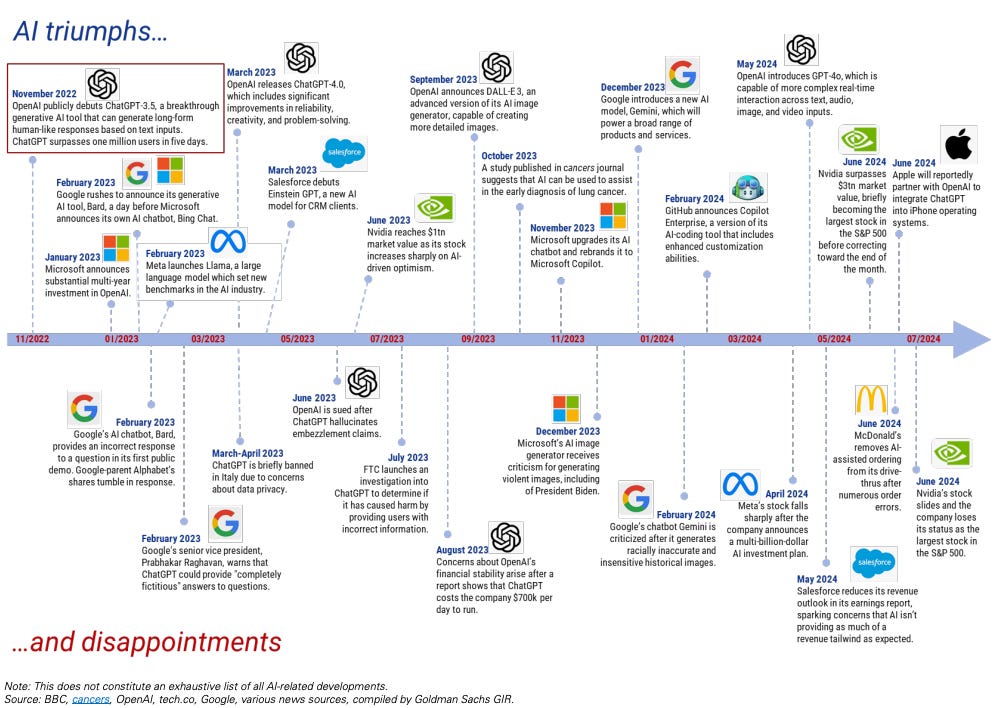

From our vantage point, the overall hype in GenAI has certainly cooled over the past 12 months, and we’re likely in the “trough of disillusionment” phase of the cycle. Goldman Sachs recently released a 31-page report with the eye-catching title “Gen AI: Too Much Spend For Too Little Benefit?” arguing that the $1 trillion in AI Capex spend may never actually pay off.

While we remain long-term optimistic about the benefits of AI, it’s clear that in mid-2024, the pendulum has largely shifted back towards companies producing real products with sustainable revenue.

So what are we seeing as VCs in the private markets?

The market is bifurcating between the “haves” and the “have-nots”. We are largely moving away from funding the 8th-best “GenAI version of X” to consolidating around technical founders building companies with true product or GTM moats, and can show a reliable path to category leadership.

Mega-rounds are becoming more common, as investors flock towards “best-in-class” AI startups, or at least ones they believe have a shot at being category leaders (e.g. Glean, Scale, Runway, etc.)

For formation and early-stage companies (Seed/Series A), entering new markets, creating new categories, building innovative new products, and catching early momentum all are increasingly important.

For early-growth and growth-stage companies (Series B/C+), showing sustainable, high-margin revenue vs. experimental, one-time bookings is important. The traditional metrics investors used to judge SaaS companies (ARR growth, net retention, burn rates) are back in vogue.

Base models are commoditizing and AI prices continue to drop (the newly released GPT-4o mini is 60% cheaper than GPT-3.5 Turbo), meaning true product differentiation and a unique value proposition is becoming the only (?) thing that really matters for startups.

Interestingly, even the term “Generative AI” seems to have fallen out of favor. Google Trend shows that searches for “Generative AI” peaked in June 2023 (about six months after ChatGPT was released) and have since flatlined. Its one sign that we may be evolving from talking about Generative AI to AI in general, and that virtually all software and technology companies are becoming AI companies.

Which AI Startups Have Benefited And Why?

Over the past year, we have evaluated hundreds of AI companies form pre-seed to Series C+. While many of these companies are still wrestling with finding product-market-fit, many have managed to grow incredibly efficiently and quickly. In some cases we’ve seen companies go from $0M ARR to $4M ARR in <6 months (!).

So why do some AI companies manage to find early success?

They had an early understanding of how to securely and compliantly leverage customers’ proprietary data to make models and end applications more performant.

Some had early access to GPUs or to the most performant models resulting in an initial unfair advantage to being able to build the best applications on top.

Their products integrate deeply into workflows and have replaced services and manually-oriented tasks. These companies can prove immediate ROI by showing that AI is faster, cheaper, and more accurate.

They entered niche verticals often overlooked by industry incumbents. Vertical applications have historically been more fragmented and ‘boring’, but AI is proving to be more performant in these verticals. Some examples:

Legal → Harvey recently raised an additional $100M at $1.5B valuation

Financial Services → Hebbia raised $130M at a $700M post-money valuation

Healthcare → Hippocratic AI raised $55M at $500M post-money valuation earlier this year

Conclusion

AI is full of juxtapositions. It’s either the best thing or the worst thing to happen to humanity (🤔). Similarly, the startup and venture fundraising market for AI tells two simultaneous stories: the number of companies being funded in the space is dropping as many early-stage companies are struggling to find sustainable product-market fit; while at the same time, megarounds are converging around emerging industry leaders.

The good news is we are still in the early innings of this cycle, and the pace of change will only accelerate from here. BigTech companies like Microsoft, Meta, Google, Nvidia, OpenAI have continued to be extremely active in the space - releasing new models, investing directly into new GenAI startups, announcing new partnerships, and actively acquiring startups (Amazon acquires Adept; Microsoft acquires InflectionAI, etc.). AI-native startups that have moved past PMF are now scaling rapidly, and we could see the first AI-native IPO in the next 12-24 months.

We expect that AI will continue to have many triumphs and disappointments, but we are only just scratching the surface!

We hope you enjoyed this edition of Aspiring for Intelligence, and we will see you again in two weeks! This is a quickly evolving category, and we welcome any and all feedback around the viewpoints and theses expressed in this newsletter (as well as what you would like us to cover in future writeups). And it goes without saying but if you are building the next great intelligent application and want to chat, drop us a line!