The Price Is Wrong

What the great divergence in public SaaS and private AI tells us about what's happening in the markets

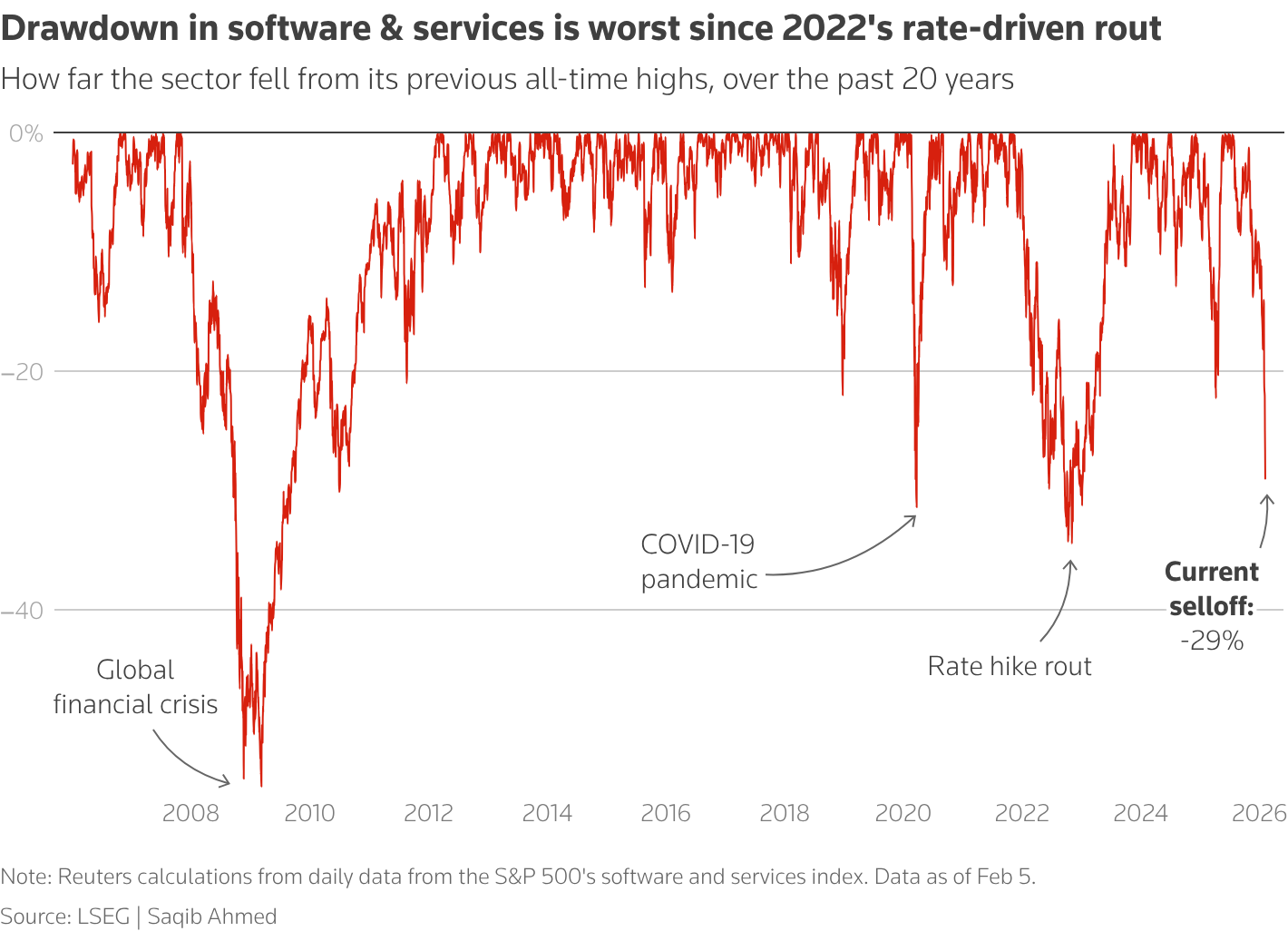

It has not been a good 2026 for public market SaaS stocks.

ServiceNow is down 32% YTD. Workday down 30% and had a CEO replacement. Salesforce is down 27%. And the BVP Nasdaq Emerging Cloud Index which tracks public SaaS companies is down 18%. February’s $300B drawdown (in one single day) has been dubbed the “SaaSpocalypse”.

Meanwhile, private AI companies are raising capital at record valuations. Anthropic is closing in on a $20B round at a $350B valuation. Decagon (which didn’t even exist three years ago) raised a Series D at $4.5B. It seems like every day there is a new AI unicorn being minted.

So how could these markets be so divergent?

Both markets are attempting to price the future of software. They just disagree on what that future looks like. And the question underneath all of it is what role AI has.

Of course we believe AI will play a massive role. The real question is who owns the intelligence, what that ownership is actually worth, and where the value ultimately accrues.

Are the prices right or wrong?

Let’s dive in.

What Public Markets Are Suggesting

Public investors are not saying software is specifically dead, but they are pricing the uncertainty of what it means to be a software company in the era of AI.

Specifically:

Will seat-based pricing compress if agents reduce human users?

Will switching costs decline if AI abstracts the UI?

Will gross margins erode if revenue becomes tied to compute or outcomes?

Will feature velocity accelerate to the point that differentiation narrows?

Traditional SaaS has been valued on the durability of its economic model:

70–85%+ gross margins (scalability)

Predictable recurring subscription revenue

Net dollar retention, primarily through seat expansion

High visibility into growth

AI disrupts the unit of value because agents don’t “buy seats.” Instead, they act like humans. They execute tasks and they generate outcomes. That shift introduces real questions about margin durability and pricing structure, and public markets, by design, discount uncertainty.

What Private Markets Are Suggesting

Private markets, on the other hand, are pricing inevitability that:

Software expands TAM meaningfully by replacing labor and completing the job itself, unlocking services dollars in the process

AI-native companies can capture software scale margins on work previously done by humans, especially as models get cheaper and optimization improves with scale

Intelligence becomes embedded in every workflow and begins to function more like a digital employee than a tool

AI enables entirely new categories that were previously impossible at scale, such as 1:1 personalized physician care or executive assistants for everyone

AI does unlock entirely new product categories and significantly expands what software can do. We are seeing that across many examples of AI native companies across a variety of domains. Companies like Cursor, Decagon, Harvey, OpenEvidence.

But just because a company is “AI-native” and has a whiff of growth does not mean it automatically deserves a 1000x (or 100x) ARR multiple.

There are plenty of challenges many of these companies still face:

Limited long term proof of gross margin durability

Unclear switching costs if agents abstract the UI layer

Pricing pressure as customers benchmark against human labor costs

Usage-based revenue volatility versus durable subscription ARR

Overcorrection on Both Sides?

Our view is that there is an overcorrection on both sides.

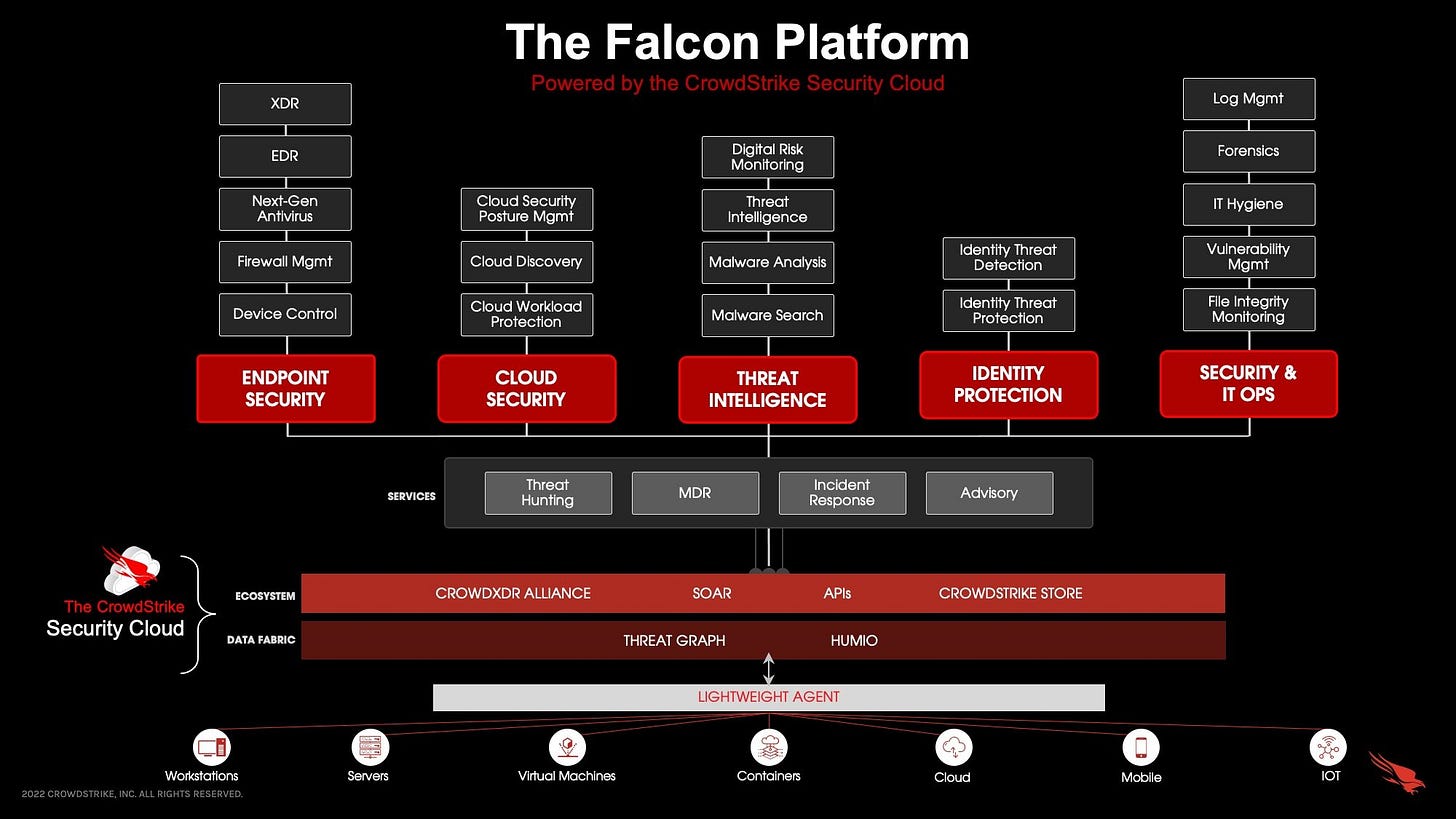

Software is still going to be needed in the “AI-era”. Companies that own critical data, sit inside deeply embedded enterprise workflows, have real switching costs, and strong distribution, will still be required in the future. Snowflake’s cloud data warehouse will be a key part of enabling AI inside the enterprise. Datadog’s observability capabilities are difficult to replace. And you can’t vibecode Crowdstrike’s security platform.

At the same time, many private AI companies are benefiting from valuation uplift despite having thin differentiation, heavy reliance on frontier model providers that are subsidizing the costs of running the models, limited evidence of pricing durability (0 to few years of renewals), unclear long-term gross margin structure (many are <30% margins or negative), and undifferentiated distribution.

So we may be seeing mispricing in both directions:

There are high-quality public SaaS companies that are being discounted too aggressively

There are mediocre AI businesses which are being rewarded too optimistically

Which is why it is so difficult to read too deeply into a snapshot of the market. We are living in a time of great change, creating uncertainty and valuation dislocations the likes of which we’ve never seen before.

So, What Really Matters?

Instead of framing this as “SaaS vs. AI,” it’s more useful to ask what role a company plays inside a customer’s system. We can break it out into:

Systems of Record: Own and structure the underlying data

Systems of Workflow: Organization of how work gets done

Systems of Action: Autonomously execute work

In an agentic world, all three layers will still matter, but their leverage shifts. Agents will rely on systems of record to access structured, trusted data. Pure workflow layers may compress as coordination becomes embedded directly into intelligent systems. And systems of action, products that can autonomously execute work, will be amplified. The companies that win will be those that control proprietary data, embed decision-making into their core architecture, understand the ontology of a company and can map across the organizational tools/roles, and evolve from dashboards that inform to systems that deliver outcomes.

It’s also important to consider how pricing evolves. For the last two decades, software monetized productivity. The seat model worked because value scaled with the number of people using the tool. Like the shift from pencil to spreadsheet, software didn’t do the work for you, it made individual employees much faster at what task they were doing.

AI shifts the value from productivity to execution.

Customers no longer just want access to data or workflows. They want the task completed. If an agent can run the workflow end to end, the seat model starts to break down. You’re not paying for access but you’re paying for outcomes. That means pricing must follow value. We expect more usage based, per action, outcome based, or hybrid models tied to work completed rather than logins or seats, a shift with significant implications for how these businesses are valued.

How Does This All Play Out?

The “SaaSpocalypse” is likely an overreaction in the short term and an underreaction in the long term.

In the near term, public markets are compressing multiples faster than fundamentals are deteriorating. The best SaaS businesses still own critical data, embedded workflows, and trusted distribution. Those advantages don’t vanish because agents exist. AI will integrate into these systems before it replaces them.

Zoom out, though, and the economics of software are clearly shifting. Seat-based pricing made sense when software improved productivity. In an agentic world, value shifts from enabling work to completing it. That changes pricing models, margin structures, and competitive boundaries. Some incumbents will evolve into systems of action. Others will discover that workflow without ownership of data or outcomes is a fragile position.

Private AI markets, meanwhile, are pricing inevitability. Intelligence will be everywhere, but intelligence itself is rapidly commoditizing. Model access is not a moat. The durable winners will own proprietary data, control distribution, embed deeply into customer systems, and price against outcomes they uniquely deliver. Both markets are extrapolating from incomplete information. The result is volatility now and real dispersion later.

So what do we think?

Buckle up… the rest of this year is going to be a wild ride!