So You Want To Go Enterprise...

How Generative AI apps can make the transition from bottoms-up to Enterprise

On Monday, the buzzy generative AI presentation tool Tome announced that they were laying off ~20% of their 59 person workforce, and were restructuring the company to “focus on sales teams” per Semafor.

This was coming off a report by The Information discussing how Tome“has struggled with internal divisions over the best target market for its product.”

While some staffers believed that a presentation tool would be best-suited for enterprise users like salespeople and marketers who made presentations on a daily basis, Tome’s founders initially wanted to emphasize selling to individuals like startup founders and freelancers.

To be clear, the fact that Tome managed to grow to 10M individual users in a short period is impressive, and every single startup goes through massive ups and downs in its early days. We are less interested in grading Tome’s current transition from B2C to B2B, but the above quote highlights the constant tension around whether and when a startup should go upmarket to the enterprise.

This is particularly interesting for Generative AI startups, many of which began life in 2022 or 2023 as product-led tools, initially gaining momentum by capturing individual users' hearts and minds and “pro devs”. Fast forward to 2024, when many of these same companies are grappling with the challenges of reaching product-market fit and growing into their valuations. Another major decision point is whether or not to target the Enterprise. However, as commonly acknowledged, breaking into the Enterprise is not easy!

B2B software companies often (but not always) find their greatest success by catering to the needs of larger enterprises. These entities boast sizable budgets and offer more stability compared to their early and mid-stage counterparts. Nonetheless, accessing this market segment involves navigating complex sales cycles, securing buy-in and budget approval from multiple stakeholders, and confronting the intricacies of deep and messy integrations. As our good friend Jake Graham, CEO and Co-Founder of Bobsled, astutely points out: "You cannot PLG the Enterprise!"

In this post, we'll explore the hurdles GenAI startups face in selling to Enterprises, along with essential factors to consider for success. Lets dig in!

Security & Compliance Are Critical

Data Privacy Regulations: Enterprises handling sensitive data require GenAI startups selling to them to comply with data privacy laws like GDPR and CCPA. A key concern is data collected by models like OpenAI GPT-3 for retraining. To address this, GenAI companies are creating proprietary models deployed within Enterprises' environments to keep data under their control. However, using pre-trained models such as GPT-3 becomes a big no-no as they risk data retraining without assurance.

Security Standards: Startups may need to comply with industry-specific security standards such as ISO 27001 or SOC 2 to assure enterprises of their data protection measures. If you are selling to regulated industries like healthcare or finance, feeding any sort of data into a general purpose model can result in major security violations, and further breaches of peoples identities.

Internal Compliance & Brand Integrity: Enterprises have a reputation to uphold. Brands like Coca-Cola, Salesforce, Louis Vuitton all care about the output of what’s created by GenAI companies. For example, if you are using a GenAI marketing tool that creates content for your brand, you need to be able to tune the output with your company’s specific requirements, including messaging, voice, and language. Cleaning up large volumes of output for brand compliance and accuracy causes more bottlenecks, defeating the purpose of adoption for speedier content generation.

We think companies like Typeface and Writer are doing a good job selling to Enterprise companies as they have built their own proprietary models, and are allowing them to train on their own datasets that don’t leave the Enterprise environment. We believe it is important to have a proprietary LLM architecture that allows you to scale up for the Enterprise.

Scaling Across Enterprise Environments Is Challenging

Integrations and Connections: Building out deep integrations and connectors is critical to drive adoption in the Enterprise. For instance, if you’re building an AI agent that sells to HR departments you might need to integrate to Workday, BambooHR, ADP, and other systems in order for the AI agent to execute on the different tasks. Otherwise, the information is silo’d and cannot be retrieved without human intervention. Building out connectors to already existing workflows drives more value to the company - otherwise humans have to.

Navigating Messy Infrastructure and Data Stacks: Many Enterprises have extremely complex data stacks. Data might be stored across several different data sources (on-prem, in the cloud across AWS, Azure, GCP, etc.). In other instances, companies may need to build out data connectors to extract data streams and events (i.e., collecting data from Amplitude or Segment). If the GenAI startup can’t access the data that already exists within the company’s environment, then the value that the GenAI tool is solving for is minimal. Understanding how to navigate and extract data out of these sources are critical for most Enterprise sales.

Scalability: Once you start selling to larger organizations, you will (hopefully) have more engagement with the AI solution. As a result, companies selling to these Enterprises will have to manage issues around being performant at scale, and dealing with a large amount of usage at once. Latency, speed, and usability at scale are critical to land Enterprise sales.

Enterprises Are Trying to Consolidate Their Tool Stack

Enterprises are increasingly pressured to consolidate their tool stack to drive more efficiencies. Training and ramping employees for yet another tool can be challenging, expensive and time-consuming. Leaders are also encouraging their teams to cut spend and make do with the current offerings.

There is also a bias for companies to leverage familiar solutions. If there is an incumbent that can do what this new GenAI startup is offering, and it’s table stakes features, then it no longer becomes that interesting to adopt a net-new GenAI solution. In this case, a company like Tome struggles because customers can build PowerPoint presentations effectively in MSFT, Google, or Notion, which many Enterprises already have subscriptions to. It’s a hard sell to convince somebody to learn and add another tool into their everyday workflow.

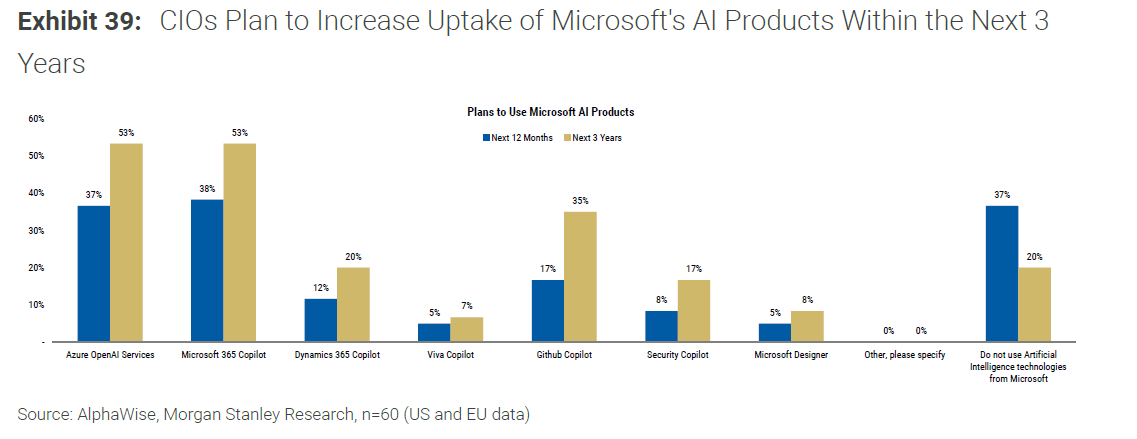

Below is an exhibit from Morgan Stanley’s Q4’23 CIO Survey that highlights how CIOS plan to increase uptake of Microsoft’s AI products within the next three years, with 50%+ saying they will use tools like MSFT 365 CoPilot within the next 3 years.

More Complexity In The Sales Org

Enterprise sales structures differ greatly from PLG or SMB/mid-market. The latter typically focuses on making it easy for customers to self-serve, with reps mostly handling inbound calls and inquiries, and helping the customer do as much of the work themselves to make a purchase. Enterprise sales teams on the other hand have a far higher number of specialized Account Executives (AEs), and surround them with a team of Sales Engineers, Solution Architects, and Customer Success Managers. As a team, they can be touching different members of the customers throughout a lengthy and complex sale (with Enterprise sales cycles occasionally spanning 2+ years!).

From a services perspective, Enterprises often require far more “white glove” support than any other customer. These services are particularly important in enterprise settings where the software is critical to the business operations and any downtime or issues can have significant repercussions. Some specific Enterprise-related requirements include:

Dedicated account managers

24/7 priority support

On-site training

Customized integrations and implementation

Rapid response teams

…etc.

So before leaping to target enterprises, leaders should ask themselves: are they willing to commit the time and resources to build an effective Enterprise sales motion? Do they have the ability to withstand sales cycles that could run several years? Are the deal sizes worth the effort required?

Shorter Feedback Loops

Quinn Slack, CEO of Sourcegraph, made an astute observation on the Tome story:

Pivoting too quickly from PLG or small orgs towards Enterprise without having the proper systems in place can be the death knell for startups. The “low end” of the market is often the best place to solicit feedback from power users, create an engaged and committed community, and move quickly. As the sales motion moves upmarket towards the enterprise, things will slow down considerably. If the product and business isn’t at a point at which enterprise makes sense, things can quickly unravel.

However, waiting TOO long before approaching enterprises can also be consequential. Slack is often cited as being a laggard moving from its hypergrowth period selling to other hypergrowth companies towards enterprises, and eventually got overtaken by Microsoft Teams. The key point is not to rush the process but to go upmarket in a thoughtful way.

Conclusion

Tome, as with many other previously high-flying Generative AI startups, began life with rapid individual user adoption, but eventually decided that selling to sales & marketers was the best path to sustainable revenue. Our perspective is “going to the enterprise” is not necessarily a panacea. There are several prerequisites that startups need to have in place before successfully moving upmarket: the right security and compliance checks, a robust sales organization, scalability, and many other features required by the Enterprise.

Good luck to Tome and other companies trying to break into the Enterprise! We are excited to see how other GenAI startups navigate this tricky, yet rewarding, transition.