Reaching For The Top

What does it take to become a Top 5 productivity app?

Hope everyone is enjoying their summer! Thank you to our now 1.3K+ subscribers, we appreciate all the continued support! Please continue to share with colleagues and friends :)

As the funding machine for AI startups continues to roar, one of the questions we consistently hear is: how big can this company get?

Going another layer deeper results in another set of questions:

How sticky is this product? Many AI apps are seeing a massive uptick in early adoption only to see an equally large drop-off once the “novelty” subsides.

How does this app differentiate from the many others that look similar? As barriers to entry in building a new app fall, competitors will certainly rush into the space.

Is there enough of ROI for new users? Replacing an existing app means learning new habits, investing time into training, and opening budget space.

As VCs, we are continually assessing startups to determine whether they can be the next big world-changing company, or the elusive “decacorn”. While serendipitous timing and luck play their part in any major success, a substantial amount of success also boils down to understanding the core components that pave the way for a business to redefine its category.

In this week’s post, we delve into what lessons we can learn from the previous generation of category-defining applications, and how these insights can guide new GenAI startups.

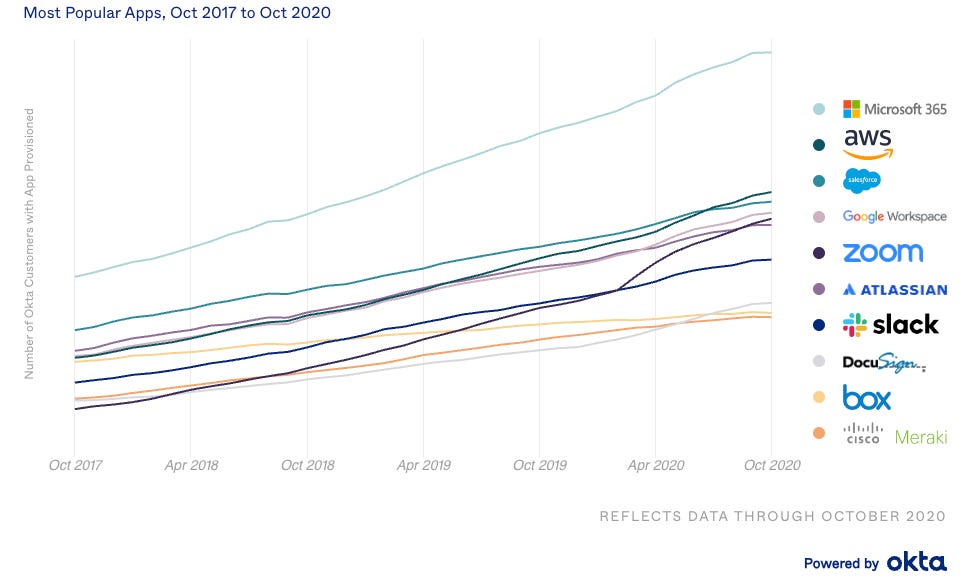

Let’s look at a select five of the highest-used, most prolific B2B products in the workforce today, according to Okta’s Business At Work report: Microsoft 365, Salesforce, Slack, Zoom, and Atlassian.

The Big Five

Microsoft 365 (Office)

Microsoft Office was first announced by Bill Gates at COMDEX in 1988, and was originally packaged as a software suite that was designed for the new wave of workers who were getting acquainted to computers at their desks. At it’s origin, there were three applications included: Excel, PowerPoint, and Word. Today, Office has evolved into Microsoft 365 and counts over 350M paid users and over a dozen highly used productivity apps.

How did they win? Our take:

Early Innovation: Office was designed at a time when computers were becoming democratized. Not only were office workers getting more acquainted to computers at their desk, but the PC was also getting more popular (large numbers of new machines started appearing in the late 1970s and 1980s).

Workflow Solution: Office consisted of Word, Excel, and PowerPoint and these applications were designed to work seamlessly together, providing a comprehensive suite for various office tasks (e.g., word processing, spreadsheet analysis, and presentation creation). This made it convenient and easy for users to switch between tasks without ever leaving the suite.

Became Known As “De-Facto”: Heavy marketing efforts to become known as the de facto standard for office productivity software, making it easier for businesses, organizations, and individuals to collaborate and share documents. Microsoft also bundled its solution aggressively with new computers and partnered directly with computer manufacturers to come pre-installed on computers. Microsoft also become de-facto in both personal and professional computing environments.

Continuous Innovation: Office continued to innovate with the times (though perhaps not all users would agree!). With the advent of cloud computing, Office transitioned to a subscription-based model. They also expanded beyond the core applications to continue dominating the user workflow (e.g., Outlook, OneNote, Publisher, and Access). Microsoft also encouraged third-party developers to create new add-ins and extensions into Office Applications, further enhancing the full capabilities.

Salesforce

Founded in 1999, Salesforce is now the largest cloud-based customer relationship management (CRM) software, with a market cap north of $200B and generating $30B+ in annual revenue. The Salesforce suite has evolved from its initial CRM offering into a multi-product suite of sales and productivity tools, underpinned by a vast data repository of customer and sales data.

How did they win? Our take:

Innovative Cloud & SaaS Model: Salesforce was a key pioneer in delivering software as a service through the cloud. This model enabled businesses to access and use software over the internet and eliminated the need for complex installations and long setup times. They were able to bolster this with a subscription-based pricing model, ultimately changing the game for how most software companies could deliver value.

Simple and Streamlined: Competitors in the space like Siebel and SAP had clunky interfaces and were difficult to use. Salesforce emphasized user experience, ease of use, and a clean product interface. This ultimately drove stickiness as users would come back to using the product every day.

Comprehensive Suite of Solutions: Salesforce initially started as a CRM, but over time offered a variety of cloud-based solutions beyond CRM (e.g., marketing, automation, customer success, analytics, and more). As a result, Salesforce has become deeply integrated across various business operations and creating high switching costs (meaning product alone won’t help new CRM startups win).

Developer Friendly: Built a platform where developers could build custom applications on top of Salesforce, and created a central community where Salesforce users could build and sell their apps.

Slack

Slack was founded in 2013, initially as a communication tool for a gaming company called Tiny Speck. Over the past decade, the company has gained significant popularity and has become one of the most widely used workforce communication tools. They were acquired by Salesforce in 2020 for ~$28B and are estimated to have >20 Monthly Active Users.

How did they win? Our take:

Simple and user-friendly interface: Slack has consistently been praised for being a user-friendly interface that is straightforward to navigate and easy for anybody to start using the platform. Slack also introduced channel organization allowing teams to create channels for topics, projects, departments, etc.

Strong app integration ecosystem: Slack allows users to integrate third-party apps into their workspace, allowing users to increase productivity and customize and streamline workflows. The ability to centralize work tools and share data and files seamlessly has users constantly returning to Slack, and driving stickiness as a result.

Product-led growth & strong user virality: Slack was a strong early proponent of a freemium model, making it easy for individual user adoption at first and eventually increasing virality and adoption by larger Enterprises.

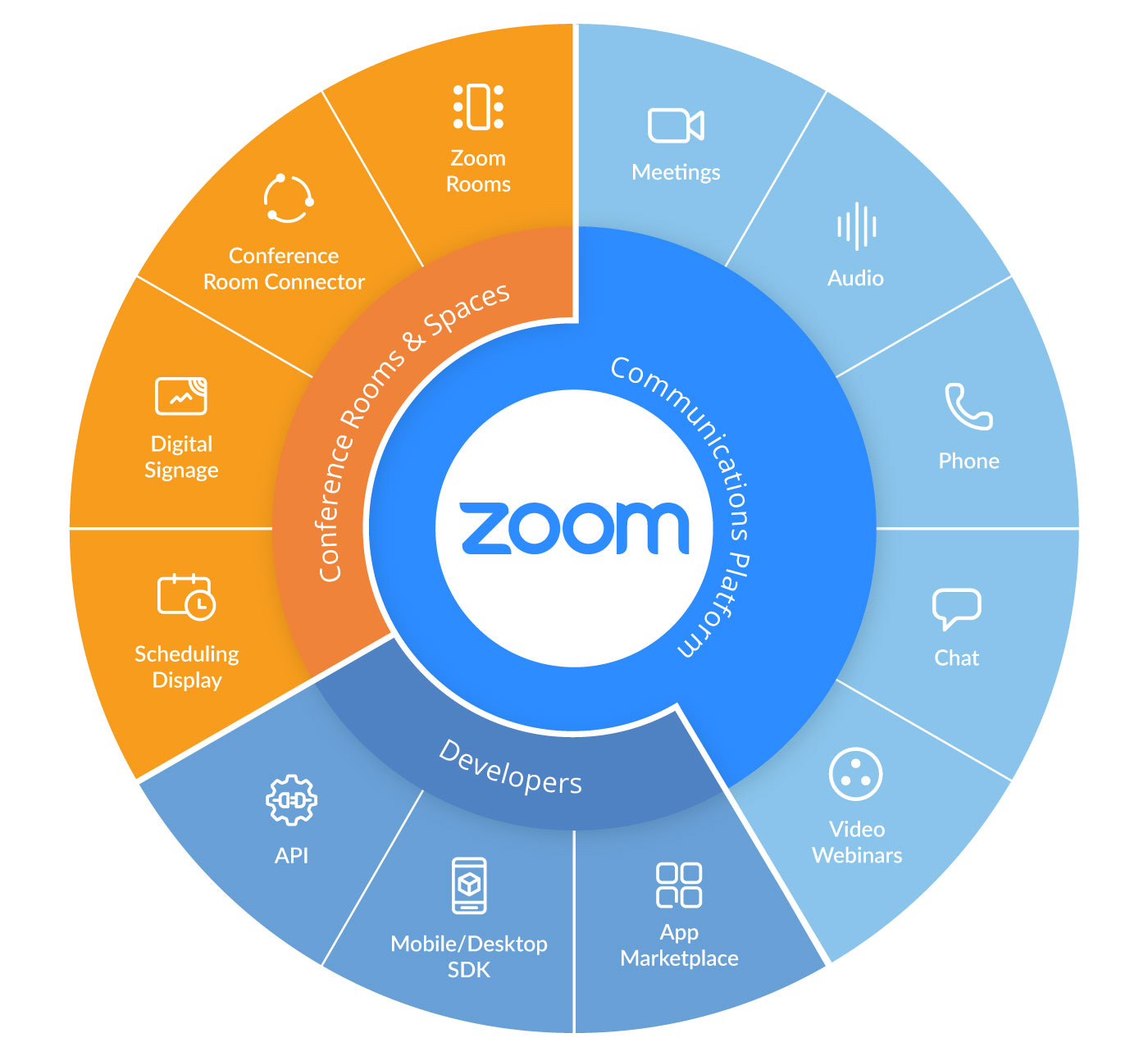

Zoom

Zoom was founded in 2011 and has become the #1 video conferencing platform today, beating out legacy incumbents like Logitech and Webex, as well as a host of “next-gen” tools and offerings from product suites like Microsoft and Google. Despite a sharp decrease in growth relative to the pandemic, Zoom continues to remain firmly entrenched on the desktop of millions of knowledge workers.

How did they win? Our take:

Best-in-class infrastructure & reliability: Zoom was truly the first video communication tool to provide a consistently reliable conferencing experience. The infrastructure was designed to handle high-quality connections, international dial-ins, and a large number of participants. No communication lag or lack of quality based on where you are. For something as sensitive as video chat, reliability is top of mind.

Ease of use: The simplicity of the product, intuitive “how-to-share” screen, and straightforward setup were key factors in Zoom’s rapid rise. The ease of use for scheduling a Zoom call and joining meetings via a single click on any device (mobile, PC, iPad) is a key differentiator.

Collaboration platform: Zoom offers the ability to “share screen” which gives participants the ability to collaborate on documents, presentations, and other materials. Participants can be anywhere in the world, and do not need to be paying users of Zoom (but the “link share” is a key element of their virality).

Atlassian

With perhaps the most unconventional founding story relative to the other leading business apps, Atlassian was founded in 2002 by two Australians trying to use software to help other support teams. Atlassian has since evolved from a bootstrapped business with a single product (bug tracking) to a $40B+ global behemoth spanning several products and 10M+ Monthly Active Users.

How did they win? Our take:

Pioneering self-serve model: For much of Atlassian’s history, they had no sales team. Instead, they focused on developing a loyal market by building a best-in-class project management tool for engineering teams. They then strategically expanded their product offerings through acquisitions to broaden their customer base to teams around the dev teams. This allowed them to keep S&M costs low, and pile more gross profit dollars back into making the product even better.

Thoughtful and Connected Product Expansion: Atlassian originally offered one product: Jira for bug-tracking. Over the years, they strategically expanded into knowledge bases (Confluence), Trello (project management), and Bitbucket (CI/CD). Throughout this expansion, they never moved away from having the developer at the center of the customer experience, meaning the products seamlessly integrate and create a delightful end-user experience.

Strategically acquisitive: Atlassian’s growth hasn’t been purely organic. They have made ~20 acquisitions over the years (such as Trello, OpsGenie, Chartio, etc.) that have bolstered their existing offerings and allowed them to enter new markets, effectively raising the switching costs of moving off the Atlassian suite.

What Are The Common Themes?

Looking at these business apps used by millions, we can see a number of common themes emerge that are applicable to startups building in AI.

Democratization of a new form of innovative technology enables category-defining applications to be built → With each of these companies, there was a technological shift that made the end application more accessible across a variety of users (in many cases it was the shift to Cloud). When there is a democratization of underlying enabling technologies, it creates a massive opportunity for a new set of applications to take hold. Lesson for GenAI startups: Tech shifts don’t happen often, but when they do, can lead to a tsunami in outcomes. Don’t take this for granted!

Sticky usage is instrumental to “getting work done” → Products have to exhibit a compelling stickiness factor and have to be the platform of choice for the end user. Each of the products detailed above are generally utilized on a daily basis (often multiple times a day). Products that integrate well into an existing workflow help achieve this. In other words, if you removed these apps from a worker’s desktop, they simply wouldn’t be able to function. Lesson for GenAI startups: Using models to generate novel or unique content is great, but ultimately won’t lead to large outcomes unless the app becomes critical to a user’s day-to-day workflow.

Integration, compatibility & a developer-friendly approach → Just as the poet John Donne wrote “No man is an island”, so too is no highly successful B2B app an island. Productivity apps do not simply need to integrate with each other in this modern era, but that is the only way they can sustain and thrive. Users may find a new product fun to try in the initial part of the hype cycle, but unless that product can integrate seamlessly with the rest of their workflow, we can expect usage to significantly drop after the novelty period wears off. Ensuring apps are compatible with each other (and the resulting developer experience is maintained), is key for an app’s success. Lesson for GenAI startups: Don’t be an island. Figure out how to integrate with other productivity tools to make it easier for the user to access your app.

Strong UI/UX and a more delightful user experience → Creating a delightful experience for the end user cannot be understated. Whether it’s Zoom’s “one click join” or Slack’s innovative approach to organizing synchronous communication, a great experience can lead to viral growth and sustained engagement. Lesson for GenAI startups: What’s your user experience hook? How can you ensure that if customers couldn’t use you anymore, they would be deeply disappointed?

What Can AI Startups Be Thinking About?

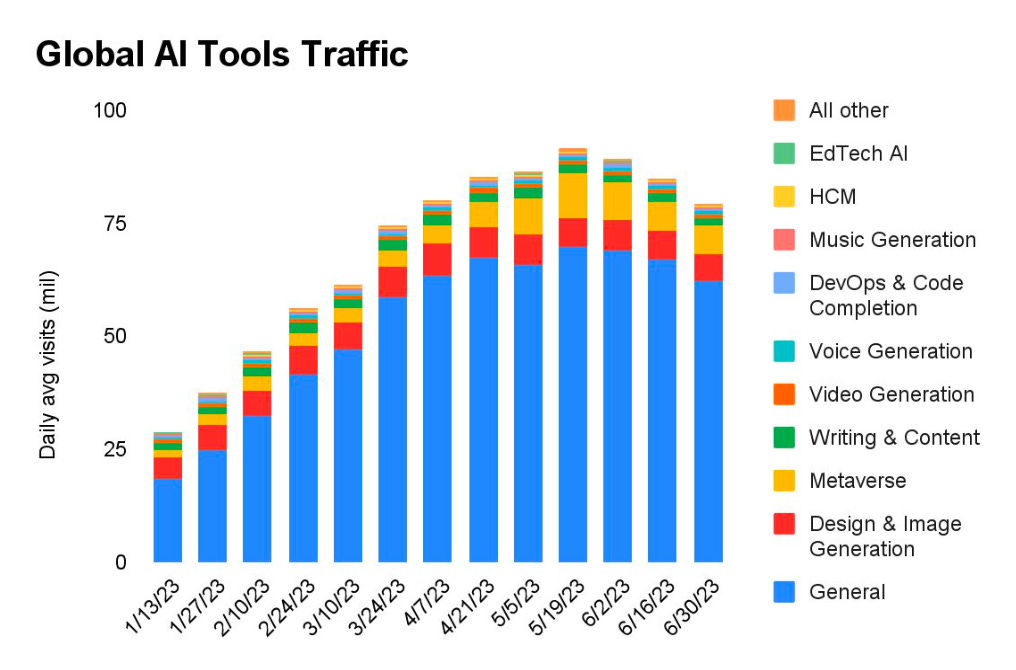

We are at an interesting point in time in the Generative AI hype cycle. As we detailed in our last post, we believe we are at the “End of the Beginning”, where the initial euphoria of generative AI is transitioning from “this is so cool!” to “how can this help me”. This is being borne out in the traffic slowdown across AI tools:

In this part of the cycle, it is helpful to look at the applications that have stood the test of time to determine a path forward. To do so, we believe Gen-native companies should be thinking about the following questions:

What can AI and Foundation Model technology do that is otherwise not achievable via traditional SaaS? One of the great things of LLMs and FMs and the associated technology is the model’s ability to reason and create newly augmented outputs. These models can think more like humans and eventually take over workflows.

How can you envelop an entire workflow and drive user stickiness? As budgets tighten, the ability to pay for yet another tool is challenging. Having “cool” products that don’t improve productivity or demonstrate ROI will be challenged. AI tools that replace and augment existing workflows, while simultaneously decreasing the time and resources needed to complete a task, will win.

Are there new business models associated with deploying AI compared to traditional SaaS? We have seen a lot of innovation with open-source models and API-as-a-service. Are there ways to leverage the work that has about the switching costs associated with building a model? What new business models might emerge?

Can we move to value-based pricing? The transition from seat-based to consumption-based pricing models was driven by customers finding value driven by usage vs. headcount. Given many GenAI apps will drive value from the quality of the outputs they generate, should we move to a value-based pricing model? Perhaps this will serve as a better incentive for apps to generate more accurate, relevant, and high-quality outputs vs. “all you can eat” consumption models.

How can I integrate and partner with the ecosystem around me? Simply put, AI applications that are siloed from the rest of a knowledge worker’s toolkit will die. Every business app that has succeeded in cracking the Top 10 in usage has done so in part due to “playing nicely” with other productivity tools. As an AI app, what is the best way to create links with both legacy and novel applications my target audience is likely using?

While the initial excitement around novel AI apps in the workforce is starting to slow down, we believe this is ultimately a great thing for the ecosystem as strong, useful, and powerful new enterprise-grade companies will emerge. It is useful to see how some of the greatest B2B apps in the market today were built.

The question is: how many of these apps will be replaced by AI-native tools in Okta’s Business At Work Report 2030?

Funding News

Below we highlight select private funding announcements across the Intelligent Applications sector. These deals include private Intelligent Application companies who have raised in the last two weeks, are HQ’d in the U.S. or Canada, and have raised a Seed - Series E round.

New Deal Announcements - 07/21/2023 - 08/03/2023:

Congratulations to our newest Madrona portfolio company, Unstructured.io on their Series A Round. You can read more about our investment here!

We hope you enjoyed this edition of Aspiring for Intelligence, and we will see you again in two weeks! This is a quickly evolving category, and we welcome any and all feedback around the viewpoints and theses expressed in this newsletter (as well as what you would like us to cover in future writeups). And it goes without saying but if you are building the next great intelligent application and want to chat, drop us a line!

It's fascinating to see how innovative companies like Microsoft, Salesforce, and Slack have won the game with their user-friendly interfaces and comprehensive solutions.