Parsing the App Layer

Where will the $100B+ of SaaS spend go in the next decade?

Last week, our colleagues Jon Turow, Palak Goel, and Tim Porter wrote a very detailed post highlighting the new advancements in foundation models, and laid out what the “stack” in the era of FMs will look like. The post has a particular emphasis on the tooling and orchestration layers (like FM Ops, deployment and inference, and developer frameworks) that sit in between the cloud infrastructure at the bottom of the stack and the apps at the top. We may be biased but we think it’s a terrific deep dive and we highly encourage folks to read the whole thing.

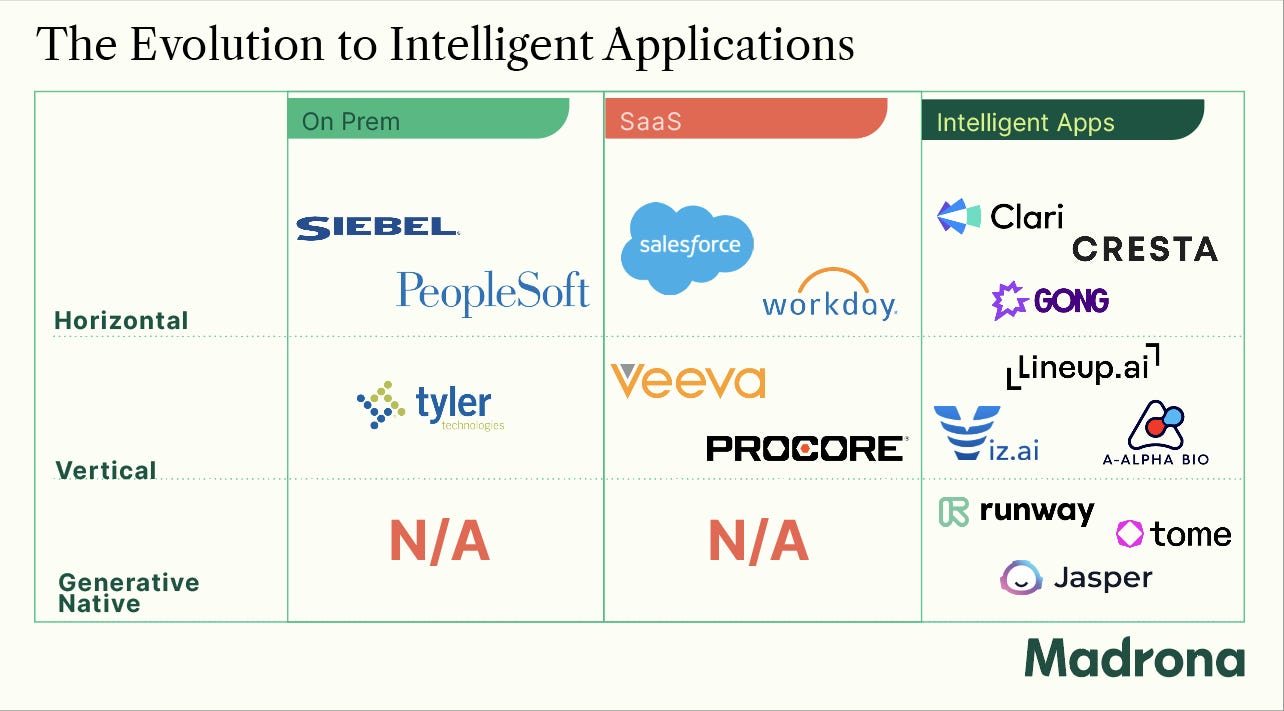

We thought this would be a good jumping-off point to focus more specifically on the applications layer itself. As Charles Lamanna highlighted in our IA Summit last year, there is a new seismic shift happening - every company today is a software company, but every company is about to become an AI company, or as we define it, an “Intelligent App”. In the prior software as a service (SaaS) era, a generation of new companies and products emerged leveraging advancements in cloud computing and distributed infrastructure: Salesforce, ServiceNow, Veeva, Atlassian, and many other behemoths scaled to many billions of revenue and market cap over the past ~20 years.

Today, there is another transformative shift underway, this time with new and existing intelligent applications being built on top of foundation models. This all begs a few questions: what does the emerging Intelligent Applications layer look like? How does it compare and contrast with the previous era of SaaS applications? And most importantly - where will we see the value accrue?

Let’s dive in.

A Refresher on Intelligent Apps

In our very first post, we defined intelligent applications as “software services with contextually relevant machine/deep learning models embedded in the application.” We believe that all apps (whether they be incumbent software applications or “AI native”) will be intelligent or they will cease to exist. We can categorize intelligent apps across three main dimensions, though we certainly expect these lines to blur over time:

Horizontally focused: These are end-to-end tools that can be used by any company regardless of sector. Crucially, they leverage AI to automate critical business processes, make predictive analytics, build smarter forecasts, and other company-wide use cases.

Vertically focused: AI-integrated software applications that address the needs of a specific sector or industry. Many startups in this category design a solution to an industry problem using software and integrate AI & ML to optimize some part of their product.

Generative Native Apps: This is a new category of apps that emerged in just the past few years. Generative Apps natively leverage large language models (LLM) trained on a large corpus of data to produce new and realistic content (images, text, code, video, audio, and more) or even auto-complete tasks (logging new leads or data into your CRM).

Horizontal Apps

As defined above, horizontal applications enable a broad set of users to leverage AI in automating critical business processes. The most canonical example of a horizontal application in the traditional SaaS context is Salesforce. Founded in 1999 as an antidote to traditional license-based software, Salesforce is the largest CRM in the world and now records $25B+ in revenue across 150,000+ customers. One of the reasons Salesforce is so sticky and powerful is that just about any company in any sector can use it. It doesn’t matter if you’re a car manufacturer, a telecom, or a cereal brand; as long as you have customers, you likely will have a need for a CRM, and you could use Salesforce.

We believe that traditional “unintelligent” horizontal tools will increasingly be replaced by “intelligent” ones leveraging the power of AI and FMs, whether they are existing incumbents or entirely new tools. These new products and tools will serve the key functions of a business, spanning sales, marketing, accounting, finance, and legal. We see a host of new ways horizontal intelligent apps can be used, such as:

Better sales forecasting - Traditional sales software tools relied on fairly basic input/output mechanisms that would generate limited forecasts from narrow inputs (e.g. the next quarter’s leads). Now, intelligent sales tools like Gong, Highspot, Clari, and Toplyne.io leverage machine learning models to synthesize vast quantities of varied data (product usage, user engagement, social media profiles, etc.) to surface and identify buyer intent well ahead of when the lead enters the pipeline.

Personalized search - Search has existed in many forms for both consumers (like Google) and across the enterprise (like Elastic), but often returned either irrelevant or nonspecific results. Modern search tools can now leverage advancements in foundation models to improve the search experience. For example, Perplexity.ai harnesses Bing API to capture snippets from reputable sources, which are then fed into the OpenAI ChatGPT model to generate highly customized answers. With more usage and better prompting, their models continue to get further refined over time. Glean is doing something similar for enterprise search. Perhaps there is a horizontal application in the future that allows you to search AND take actions (e.g., give me an itinerary for Mexico City, and then book my flights, hotel, and restaurants based on my preferences).

Contextualized customer service - Prompt, relevant, and accurate customer service has been the holy grail likely since the first buyer wanted to return an item (perhaps the Bronze Age?). AI and ML can help make this a reality. From Forethought to Cresta to more recently Intercom, next-gen customer support/service tools are processing both structured and unstructured data to prioritize tickets, perform sentiment analysis, summarize help center content, and resolve issues even BEFORE a customer submitted a complaint.

Vertical Apps

Vertical SaaS has also made major strides in the past two decades, with software tools penetrating industries as diverse as construction (Procore), life sciences (Veeva, Benchling), banking (nCino), and restaurants (Toast). Part of the beauty of vertical SaaS is that even if the total market size is limited or the number of end customers is constrained, companies can offer multiple products to address a broad set of needs. For example, Toast’s core offering is a point of sale (POS) device for restaurants, but they also provide tools for scheduling, payroll and team management, payment processing, and access to financing and capital.

While horizontal SaaS benefits from broad distribution, vertical SaaS is advantaged in being able to go very deep into a specific industry, collecting relevant, salient data across its entire customer. This makes vertical SaaS prime for an AI-first approach. Intelligent applications deployed vertically can quickly amass a larger degree of relevant training data, and better model optimization trained for specific tasks. We believe applying AI/ML with deep domain expertise will yield massive businesses. We are already seeing intelligent applications penetrate large verticals, such as:

Healthcare: Viz.ai leverages machine learning models to help radiologists analyze scans and diagnose illnesses more quickly than if they were to perform those same tasks manually, paired with a care coordination platform to improve the overall patient experience. Digital Diagnostics uses AI and skin images to autonomously detect skin diseases such as melanoma and squamous cell carcinoma.

Biology & Life Sciences: A-Alpha Bio combines synthetic biology with machine learning to measure, predict, and engineer protein binders. By generating proprietary protein binding data at unprecedented scale and quality, A-Alpha was able to use machine learning to more effectively understand and engineer protein interactions. Recursion, a next-generation biopharma, collects and processes massive quantities of data through specialized hardware and software, combined with biological and chemistry tools, to radically alter the drug discovery process.

Food Services: Lineup.ai generates automated, AI-powered sales forecasts and schedules for restaurants, using historical and real-time revenue and labor data. Valyant.ai has developed a conversational AI platform specifically focused on Quick Serve Restaurants (QSRs), helping increase up-sells and reduce wait times.

Generative Native Apps:

Generative Native Apps refer to an entirely new category of applications that leverage large language models to generate new content without needing explicit instructions (but rather “prompting”). The content can be expressed across a number of different modalities, such as text, images, code, video, audio, speech, or proteins. Generative Native Apps did not previously exist in the SaaS era but emerged in the last few years thanks to major advancements in FMs and LLMs. While we categorize Generative Native Apps as a separate subsegment of the broader intelligent applications world, we believe these categories will blend over time as Horizontal and Vertical Intelligent App companies will have generative features embedded into their products (e.g., simple offerings like text autocomplete or email generation).

Generative Native Apps are being built with FM technology at the core infrastructure and enabling layer which gives companies here a few key advantages:

Lower cost of ownership: Companies building Generative Apps have cost advantages given many are calling an API to an external FM/LLM (e.g. OpenAI’s API) vs. having to train and fine-tune models entirely in-house.

Faster time-to-market: Companies building Generative Native Apps can deliver value to customers faster. This is driven by the ability to leverage FMs and fine-tune them as opposed to having to train, host, and build custom models. We see some parallels here to cloud-native development and DevOps processes and automation in the SaaS era.

Elastic scalability and flexibility: Companies have the ability to grow or shrink infrastructure resources dynamically as needed to adapt to workload changes. They also don’t need to build infrastructure to run FMs, but are able to leverage the models via API.

Today, the most advanced FMs are text (e.g., GPT-3, Cohere) and image (e.g., DALL-E, Stability) based models. This describes why we are seeing many applications leveraging text and image modalities. Some Generative Native App examples include:

Text (Marketing, Copywriting, Notetaking): Jasper, Otherside, and Compose leverage FMs like GPT-3 to help marketers, designers, and sales reps write both long-form and short-form text. This saves users time as they don’t have to “start on a blank canvas”. SuperNormal automatically transcribes notes through integrations with video call and calendar apps. Mem.ai is a “personal Google” that uses AI to store all your personal information and then makes that information more accessible and usable.

Image & Video Generation: Runway and Lensa are built on top of Stable Diffusion and offer a platform that allows users to generate new creative content and images leveraging photos that are either uploaded by a human or found on the web.

Multi-modal (Combination of image, text, code, etc.: Tome uses text prompts to generate entirely new and fully completed presentations from scratch, compared with Powerpoint which just provides the tools to build a presentation. Diagram is a new design tool that harnesses AI to help designers generate powerful prototypes and create new products.

Today, most Generative Native Apps are being deployed in high affordability use cases. High affordability is when the generated content does not have to be 100% accurate (e.g., Gmail suggests the next word or sentence in your email). In this case, having 100% accuracy is not necessary because the human still has full control to accept or decline the suggested phrase. In use cases where there is low affordability for inaccuracies (e.g., finding the right interest rate in a legal document to build a mortgage plan from) generative native applications still have a ways to go. We are excited to see new modalities emerge in the coming years ahead.

Conclusion

The SaaS era that emerged from the late 90s created an industry now measured in the hundreds of billions in market value: Salesforce ($170B), ServiceNow ($90B), Workday ($45B), Veeva ($27B), and countless other public and private software companies were built and scaled during this period. We believe that the next decade will be defined by intelligent applications: products applying machine learning and artificial intelligence to historical and real-time data to deliver contextually relevant and deeply personalized user experiences.

This is definitely not to say that Salesforce or ServiceNow are going away (they won’t). But we fully expect the SaaS giants of the past era to embrace AI, and are excited for the next generation of novel apps built on foundation models. We believe there will be multiple winners in each category across Horizontal, Vertical, and Generative Native Apps.

There’s no definitive answer on where the next $100B+ of SaaS spend will go this decade, but what we know for sure is it’s certainly an exciting time to be in the ecosystem.

Funding News

Below we highlight select private funding announcements across the Intelligent Applications sector. These deals include private Intelligent Application companies who have raised in the last two weeks, are HQ’d in the U.S. or Canada, and have raised a Seed - Series E round.

Special shoutout to the entire DevZero team on the announcement of their $26M Seed and Series A funding round! DevZero offers a cloud-based development platform that makes it easy for organizations of all sizes to configure, secure, and scale development environments to boost developer productivity.

New Deal Announcements - 01/20/2023 - 02/02/2023:

We hope you enjoyed this edition of Aspiring for Intelligence, and we will see you again in two weeks! This is a quickly evolving category, and we welcome any and all feedback around the viewpoints and theses expressed in this newsletter (as well as what you would like us to cover in future writeups). And it goes without saying but if you are building the next great intelligent application and want to chat, drop us a line!

Super helpful read, thanks for another awesome writeup!

I'd love to hear your thoughts on the "lower cost of ownership" angle played forward. Running these models is expensive (Ex. ChatGPT is likely ~$100k/day https://twitter.com/tomgoldsteincs/status/1600196995389366274?s=20) so it seems plausible that the providers will need to turn the pricing dial up soon (even as the cost of compute continues to fall, it'd be a multi-year timeline before it makes LLMs super cheap).

How do you think the companies built on these FMs should plan for those increases? Is it a case of creating enough value for a vertical where your customers are ok paying up down the line?

Very insightful content. As an entrepreneur in the same space, this article was really helpful in understanding the current rapid progress and trends across industries in generative AI space. Looking forward to more such content. Cheers.