Notes for the AI Class of 2023

Airplane, InVision, and what we can learn from the prior software run-up

Please subscribe, and share the love with your friends and colleagues who want to stay up to date on the latest in artificial intelligence and generative apps!🙏🤖

Last week, we heard the news that Airplane, a buzzy developer platform for internal tools, was acquired by Airtable. The news caught the attention of Hacker News and other tech bloggers as it came as a bit of a surprise to outside observers; Airplane had raised $40M in venture funding (most recently a $32M Series B in September 2022), included several prominent investors on its cap table like Benchmark and Thrive, and maintained generally strong product reviews.

How could a seemingly well-funded and well-liked company be so quietly acquired (or really acquihired) and opt to sunset its product in <60 days?

The reality is that in 2024, we expect to see many previously high-flying startups make difficult decisions about taking an early exit or having to close their doors. Airplane was just one among several well-funded private companies to shutter or pivot towards a different path:

InVision ($350M raised) discontinued core services last week

Convoy ($1B raised) shuttered in October due to both an “unprecedented freight market collapse” and “dramatic monetary tightening.”

OliveAI ($850M raised) also folded in October after cutting corners and failing to meet customer expectations

To be clear - we have no inside knowledge of what happened at Airplane, and acquisitions + shutdowns are a natural part of the startup lifecycle. We wish nothing but the best for both the Airplane and Airtable teams, as well as the many fantastic individuals at all of the companies who had to make hard decisions.

However, we believe there are still some important lessons that the “AI Class of 2023” can learn from its predecessors to avoid landing on 2024’s shutdown chart.

Let’s dig in.

Lesson #1: Avoid Raising Too Much Ahead Of Product Market Fit

Dave Packard is attributed with one of the great quotes in Silicon Valley lore:

“More organizations die of indigestion than starvation”

While often repeated, the value of this quote was generally lost in the heyday of 2021/2022, when billions of dollars in VC and crossover money was stuffed into startups. What we are recognizing (often painfully) now, is that raising too much money ahead of finding product-market fit can be the kiss of death.

Kevin Gibbon, former founder of Shyp and current founder of AirhouseHQ, put it well: “If you haven’t validated you have something your customers love and you can scale to produce the expected venture return this can be (and was for me) one of the nails in your coffin.”

In other words, every new dollar of capital invested into a business just raises the expectations of what that business needs to become. For a company that raises tens (or hundreds) of millions ahead of actually establishing PMF, two key issues arise:

The preference stack can become so large that it reduces the exit options available to the startup. For example, for a company that raises $100M in VC, a minimum $100M exit is needed just to return 1x back to the preferred shareholders…and only above that do other shareholders make a return!

A high-burn culture seeps in. With millions in the bank, teams may attempt to spend their way into finding PMF, instead of it coming organically, leading to bloated org structures, inefficient spending, and “death by indigestion.”

We’ve profiled previously how GenAI startups have been the biggest beneficiaries of venture dollars in 2023, much of due to the intensive compute, training, and talent costs associated with running these businesses. However, the same rules apply: be smart about how much $$ you take on before finding the vaunted product market fit in your category.

Lesson #2: Avoid Overhiring

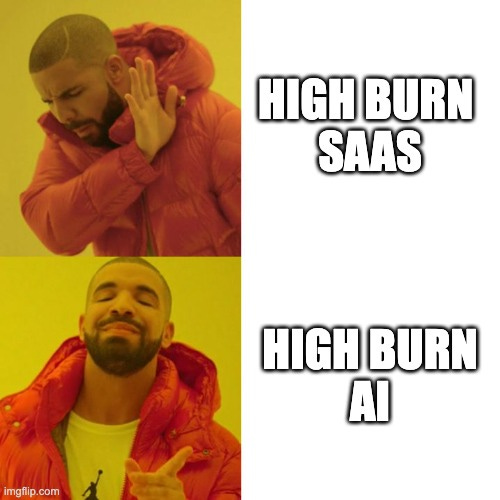

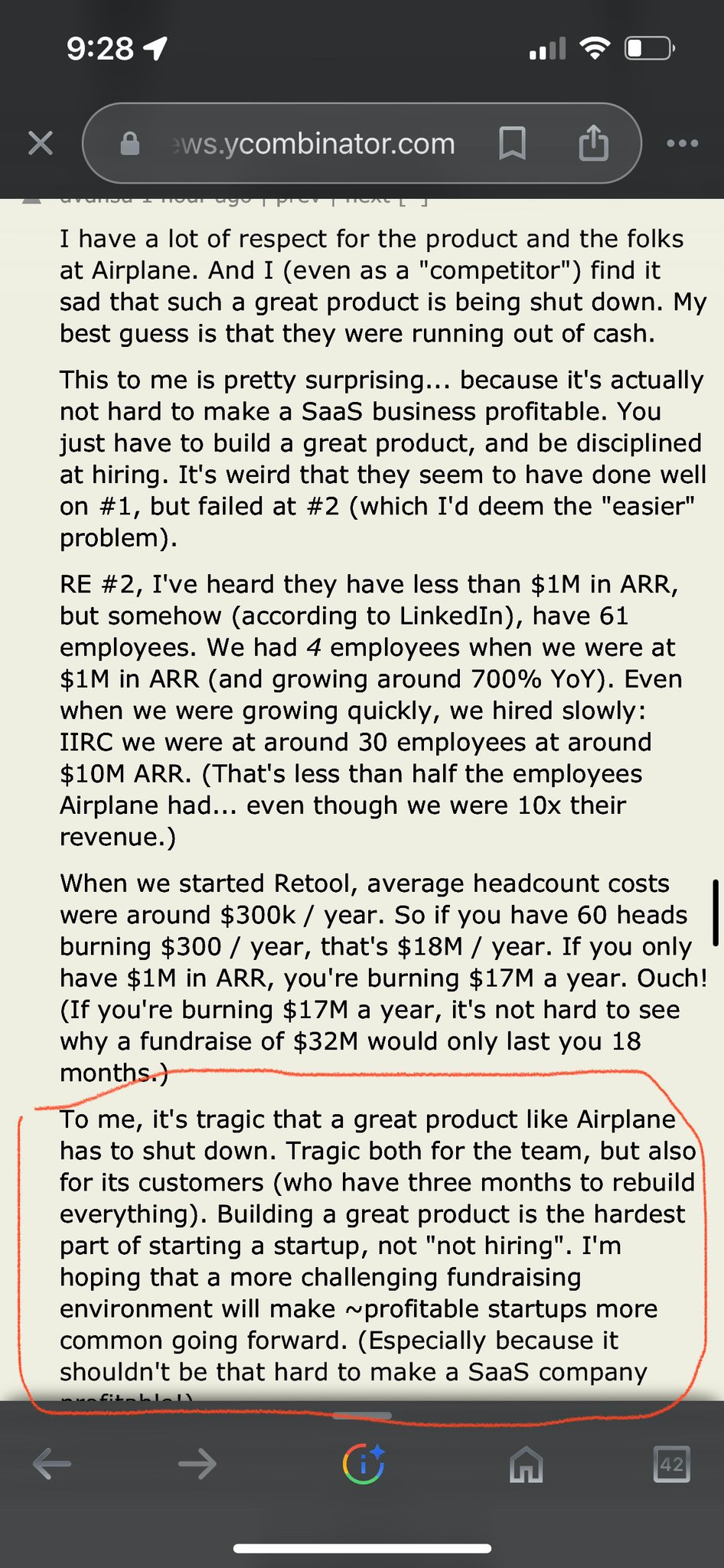

Even after finding product market fit, scaling too quickly and overhiring relative to traction can be another proverbial nail in the coffin. David Hsu, the founder and CEO of Retool (a competitor to Airplane), made the point that Airplane may have had ~60 FTEs despite only at $1M ARR (~$17K ARR/FTE). Comparatively, Retool had 4 employees at $1M ARR ($250K ARR/FTE).

Without speculating on the specifics, David’s broader point is a good one: “building a great product is the hardest part of starting a startup, not ‘not hiring’”.

Another recent example is Pitch, a next-gen presentation tool based in Germany. After raising nearly $140M, the founding team realized the venture funding had led to unrealistic expectations and an unsustainable path for the company. Pitch had more than 100 employees on ~$4M ARR (~$40K ARR/FTE), before deciding to reset the cap table and reduce the team by 2/3rds.

The greatest strength that a startup has relative to a well-funded and well-staffed incumbent is the ability to be nimble. Unfortunately, that superpower can be obviated by overhiring and adding multiple heads when fewer are needed (this doesn’t just apply to startups either, as Meta has shown).

For AI companies, it’s important to avoid the mirage of staffing up for the sake of “getting bigger”. In fact, outside of the big model players who require tons of $$ for compute and training (see: Anthropic), we would expect that AI apps can run even more nimbly than traditional SaaS startups due to the breadth of automation tools at their disposal (see: Duolingo).

Lesson #3 - Avoid Getting Your Financials Conflated

Everybody, founders and investors alike, naturally get excited when they see any sort of hockey stick growth. Last year, Jasper reportedly reached ~$100M ARR and Lensa reached more than $70M Revenue from the App in November 2022 alone. As VC investors, we also observed numerous AI apps achieving remarkably impressive growth —going from $0M to over $10M Revenue within a year became a "common" occurrence, often resulting in significant valuation boosts.

Nevertheless, solely focusing on Revenue and ARR growth cannot sustain a durable business. In reality, the kind of rapid, exponential growth prevalent among many GenNative companies can be misleading, and AI startups must remain mindful of business fundamentals and finance hygiene, like:

MRR vs. ARR: Many businesses and customers are eager to explore new GenAI products. In the B2B sector, there's a noticeable rise in experimental budgets for these products. Customers may often opt for monthly subscriptions that automatically renew each month; however, this can be deceiving because they might cancel after a short period instead of committing to an annual subscription. It's important not to confuse these "monthly recurring" subscriptions with ARR. Multiplying the monthly figure by 12 doesn't accurately reflect the company's position because these customers haven't committed to true annual subscriptions. Remember, ARR = MRR x 12 only when the customer base remains constant!

High gross margins - Solid software businesses typically maintain gross margins of 80% or more. The ability to scale efficiently without requiring customized services for each customer is crucial. However, many AI companies experience margin degradation, sometimes dropping to 50%-60%, primarily due to the costs associated with model inference. We wrote more on AI COGS here.

Recurring customers - A loyal user base is essential for sustainable business growth. Encouraging customers to commit to annual or multi-annual contracts ensures long-term dedication to a product. Understanding the customer base—whether it's B2B contracts or end consumers—is also crucial. Notably, with many GenNative products, end customers (consumers like you and me) often lack the same purchasing power as businesses.

Path to Profitability - While software public markets had previously prioritized ARR and revenue growth, there's been a shift back to core business fundamentals and growing efficiently. Establishing a clear path to profitability without burning hundreds of millions of dollars is crucial for long-term sustainability in business.

While initial top-of-funnel growth may appear impressive, GenAI businesses must possess strong foundational principles and avoid getting caught in the 2021 “growth at all costs” mindset that is now creating difficulty for so many SaaS startups.

Conclusion

We appreciate that we are still in the early innings of the GenAI wave, and there is plenty of time for companies to manage growth and for winners to emerge. But AI startups would be wise to study the SaaS run-up of 2021 to avoid similar stumbling blocks.

Our suggestions?

Manage growth expectations. Don’t expect that 5x, 10, or 50x growth can be sustained in the long-term. Experimental budgets from 2023 will fade, buyers will be more discerning, and the ROI will be back in vogue.

Be smart about hiring. Adding headcount for its own sake, especially before achieving product market fit, can be a road to nowhere. Some of the best AI companies are finding they can do more with less; just look at MidJourney which purportedly does $200M+ in revenue with ~40 FTEs.

Control costs. Take advantage of free open-source models, and be aware of API costs, as AI spend can spiral out of control quickly. Don’t rely on paid marketing alone to sustain growth. One of our favorite growth hacks is from Bill Gurley: “Set paid marketing to $0. Instant creativity.”

Build and fortify IP moats. Create extensibility in your platform by allowing other companies to build on top of you. Eliminate future tech debt through an infrastructure stack that leverages different foundation models based on specific use cases. Deliver personalized experiences using proprietary data and user interactions.

As Mark Twain quipped, “history doesn’t repeat itself, but it often rhymes.” While the AI explosion of 2023 will create a multitude of generational companies, many of its characteristics (massive funding rounds, unsustainable growth, high burn rates) remain eerily reminiscent of the 2021 SaaS run-up. By studying this prior era, AI founders an better navigate the current landscape, and set themselves up for long-term success.

We hope you enjoyed this edition of Aspiring for Intelligence, and we will see you again in two weeks! This is a quickly evolving category, and we welcome any and all feedback around the viewpoints and theses expressed in this newsletter (as well as what you would like us to cover in future writeups). And it goes without saying but if you are building the next great intelligent application and want to chat, drop us a line!

It’s interesting that the SaaS and ZIRP phenomenon of blitzscaling, popularized by Reid Hoffman, is basically defunct now

We’re entering an age of lean startups that will attempt to be cash flow positive asap. A welcome correction