Navigating Turbulent Waters

How tariffs, trade wars, and market tumult could impact startups & the venture ecosystem

Please subscribe and share the love with your friends and colleagues who want to stay up to date on the latest in artificial intelligence and generative apps!🙏🤖

Well, it’s been an interesting week in the markets to say the least.

A quick timeline of the past week in Tariff Land:

April 2, 2025 ("Liberation Day") → President Trump announced new "reciprocal tariffs" ranging from 12% to 50% on approximately 60 trading partners. Additionally, a flat 10% tariff was applied to goods from nearly all other U.S. trading partners, excluding pharmaceuticals and microchips.

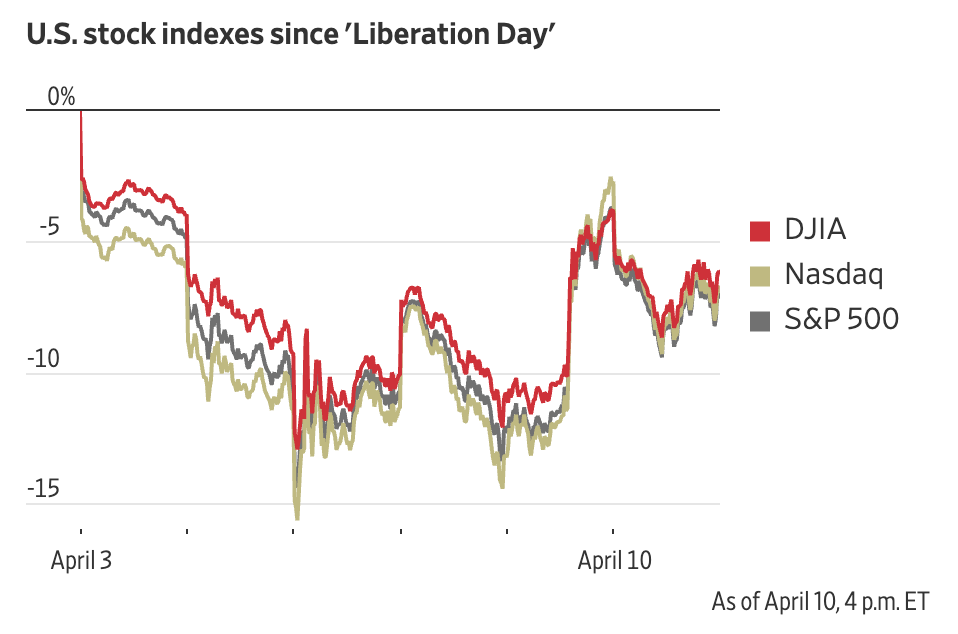

Markets plunge, with major indices declining over 5% in the week following the announcement, marking the largest downturn since the COVID-19 pandemic.

April 9, 2025 (“The Reversal”) → Trump announced a surprise 90-day suspension of most new tariffs (excluding those on China) to allow for negotiations with over 75 countries.

U.S. stock markets surged dramatically: the Dow Jones Industrial Average gained nearly 3,000 points (+7.9%), the S&P 500 rose by 9.5%, its third-best day since 1940. Nasdaq soared by 12.2%, marking its largest single-day gain in decades.

April 10, 2025 (“Trade War Sets In”) → Analysts warned of continued volatility due to unresolved U.S.-China trade tensions and potential inflationary impacts from tariffs.

Markets again swung back down, giving up many of the previous day’s gains. The S&P 500 sold off 3.5%, the Nasdaq slid 4.3%, and the Dow Jones dropped 2.5%.

TGIF!

What to make of all this volatility? Clearly the topic du jour in tech and startupland has shifted from “AI, AI, AI” to “tariffs and trade wars”, and it’s no surprise that founders, investors, and industry observers have been left scratching their heads about what’s next.

We are no experts on global trade or tariff policy, but from what we are observing in the venture markets, our advice to founders in this whipsawing frenzy is simple: hope for the best, and prepare for the worst. The one thing we can likely expect moving forward is things will get hairier and more turbulent.

Below are a handful of predictions and takeaways for founders and startups navigating this changing global landscape. Spoiler alert: resilience is about to become a competitive advantage.

Fundraising and Liquidity

The IPO window may have closed → How quickly things can change. Just a few weeks ago we had several private tech companies filing their S1s. Now, many of those same companies are reversing course. Klarna, StubHub, and Chime have reportedly put their IPO plans on pause due to market choppiness. As we’ve seen in prior cycles, it may take several quarters before companies and bankers feel the IPO window is back open, delaying the much-needed liquidity the venture ecosystem requires to operate.

Late-stage growth investing will slow down → With IPOs being shelved and public market multiples dropping precipitously, we may see the fundraising market for later-stage (Series C to pre-IPO) companies dry up. While AI provided a necessary breath of fresh air post-COVID, it becomes more difficult to justify 75-100x ARR multiples when the median SaaS company is now trading at <5x NTM revenue and exit paths begin to narrow. Of course, for best-in-class companies leading their categories (e.g. Cursor), nothing really changes.

Venture $$ will shift to seed and Series A → As a result of the above two, we could actually see a major influx of cash in the very early-stage markets when later-stage and multi-stage VCs shift their focus to seed and Series A. Semil Shah at Haystack captured this sentiment well, noting that we saw a similar dynamic play out at the end of the COVID boom.

Startups and Sectors

What sectors do we think will be negatively impacted by the trade wars?

Hardware, robotics, and supply chain-centric companies → This is probably the most obvious area of impact. Hardware has been back in vogue in the venture space over the past two years, but companies dependent on overseas manufacturers (particularly in China) may see significant margin compression or will be forced to raise prices. Robotics, which has seen a renaissance in funding recently, may also be impacted. Per The Information: “Tariffs on Asian imports, ranging from smartphones and servers to building materials and specialized motors, are already impacting companies involved in AI data centers and robotics.”

eCommerce and DTC → Many direct-to-consumer vendors and merchants procure their supply overseas and sell through online retailers like Amazon. With the Trump administration’s 145% tariff on China, prices will likely escalate. “More than 60% of Amazon’s e-commerce sales come from outside sellers, many of which are based in China or manufacture there. Some Amazon sellers have already started hiking their prices for shoppers.” per The Information.

Chip companies and chip-dependent startups → While semiconductors today are exempted from Trump’s tariffs, that may not last. With significant chip production happening overseas (at TSMC in Taiwan and Samsung in South Korea), startups that are procuring or dependent on chips could see a major pricing spike. As noted in The VC Corner blog: “With tariffs on chips doubling in key regions and export controls limiting access to the latest silicon, costs are spiking. Startups building their own inference infrastructure are being hit hardest—paying premiums on every imported server, board, and GPU. Even older-generation chips from Asia now come with a hefty tariff tag.”

General Business Dynamics

Tariffs drive long-term uncertainty, forcing a business reset.

Deals on Pause: Adam Mansfield, a consultant at Boston-based UpperEdge who advises large enterprises on software negotiations, says clients spending millions annually with vendors like Microsoft, Salesforce, SAP, Oracle, and ServiceNow are hitting the brakes. “Budgets were already under pressure heading into 2025, and the market crash has prompted customers to tighten them even further,” he said.

Ripple effects across business operations: With tariffs effectively acting as a tax on imports, the cost of goods and materials will climb. Businesses now face a binary choice: pass those costs onto consumers, risking demand, or absorb them, squeezing thin margins. This uncertainty is creating cascading effects across the enterprise landscape:

Rising Prices: While consumer segments will likely bear the brunt, the tech sector is also exposed. With core components like semiconductors and chips heavily reliant on China, the pressure is system-wide. We could see more impact here if there is change in what’s included within the tariffs.

Hiring Freezes & Layoffs: Companies are reallocating capital away from growth initiatives like hiring and expansion, opting instead to cushion against rising input costs. In a foggy macro environment, long-term commitments feel increasingly risky.

Acceleration of tech adoption amid constraints. Challenging times often breed innovation. As cost pressures mount, companies may look to accelerate tech and AI adoption to do more with less:

Emergence of Supply Chain Startups: Tariffs create complexity and friction in global supply chains, forcing companies to evaluate sourcing, logistics and vendor relationships, no mater what sector you operate in. Supply chain forecasting tools like Atomic Supply and others pricing and supplier risk management could see accelerated adoption.

AI-Driven Productivity Gains: With headcount expansion off the table for many, investments in AI tools that enhance employee output may rise, as businesses seek to maintain momentum with leaner teams.

Conclusion

While the technology sector may be more resilient than consumer-facing industries during downturns, it’s far from immune. Rising COGS and macro uncertainty will tighten enterprise budgets, leading to reduced spend on software, infrastructure, and services. On a global scale, retaliatory tariffs on American-made hardware and software could also further limit market access and margin potential.

Yet amidst this disruption, there will undoubtedly be winners and new technology will emerge - companies that help businesses localize supply chains, manage pricing volatility, or drive greater productivity through automation. Supply chain intelligence, procurement platforms, and AI-driven ops tools could see accelerated traction.

To reiterate our message to founders and startups from up top: hope for the best, but prepare for the worst. The markets are likely to remain choppy and turbulent until we find long-term resolutions. This will have a downstream impact on everything from near-term IPOs to private company funding. We are excited to see how early and growth-stage companies, venture investors, and operating teams adapt to the ever-changing macro environment.

Amidst the volatility, we’re reminded of the great Churchill quote: “Never let a good crisis go to waste.”