5 Takeaways from the 2024 IA40

Digging into the insights behind this year's list of top AI applications

Please subscribe, and share the love with your friends and colleagues who want to stay up to date on the latest in artificial intelligence and generative apps!🙏🤖

This is a repost of an article written by our colleagues Rolanda Fu and Matt McIlwain announcing the 2024 Intelligent Applications 40, our fourth annual list of top AI apps and enabling infrastructure.

This week Madrona announced the 2024 Intelligent Applications 40, highlighting this year’s most compelling private companies leveraging artificial intelligence and machine learning. We received over 380 nominations from more than 70 venture investors across 54 top-tier venture and corporate investment firms and continued our partnership with Pitchbook to incorporate its data-driven scoring into the voting process to further enhance the rigor and research behind our decision-making.

The intelligent applications landscape has continued to evolve rapidly since our initial list in 2021 and last year’s 2023 cohort. Models have improved speed, accuracy, and multimodal capabilities, with releases such as GPT-4o and GPT-4o mini, Claude 3.5 Sonnet, and Gemini 1.5. At the 2023 IA Summit, we observed several key themes that continue to persist, including the mainstream adoption of AI and the high proliferation of AI applications. Since the 2023 Summit, we have continued to explore the rapidly evolving landscape of GenAI and began following the rise of AI agent infrastructure, which has generated new opportunities across application and platform layers.

Key Takeaways from the 2024 IA40

1) Generative-native AI companies continue to see high growth, particularly in enterprise productivity

Gen-native applications (i.e., those launched in the AI space and built on top of foundation models) that can help solve for knowledge search and management, workflow acceleration, or assist with GenAI content creation across teams continue to see success with enterprise customers. AI application companies such as Glean, Writer, and Hebbia have worked to integrate themselves with enterprise systems as powerful AI partners. These companies showcase a wide range of dynamic capabilities to remain accessible yet relevant for different end users. Newer gen-native AI companies such as Yurts are also exploring the market for enterprise efficiency while addressing adjacent markets such as government agencies that could benefit from similar solutions. We have also continued to see new growth with vertically focused productivity solutions that address specific customer problems in spaces such as healthcare (e.g., Tennr), software development (e.g., Codium), and sales (e.g., Clay). We expect winners in the enterprise productivity AI space to emerge more clearly in the next couple of years.

2) Generative-enhanced applications persist in their ability to deliver value-add AI capabilities for their customers

In 2023, we noted that gen-enhanced companies (i.e., companies that did not begin as AI companies but have enhanced their core products with GenAI) have advantages in engaging their existing customers and leveraging their brand. Incumbents such as Canva and Figma continue to execute well in enhancing their existing workflows and offerings to help their customers extract more value. They have proven their ability to adapt quickly to compete with offerings from gen-native applications and their strength in pursuing partnerships to accelerate their AI solutions. This is “as we predicted” last year, but we believe that gen-enhanced companies can emerge as truly disruptive category definers/winners in the medium term.

3) Companies are exploring new autonomous capabilities of AI to take on tasks

Improvements in models and platform infrastructure (e.g., frameworks like LangChain) have made it possible for companies to more actively pursue the development of autonomous AI agents. These companies are building agents to tackle a wide range of different functionalities. MultiOn is working to create AI agents that can perform a wide range of online tasks, while Factory aims to transform the software engineering space by automating tasks such as writing tests and documentation to streamline the development lifecycle. Dropzone is also pursuing unique use cases for its AI agent to autonomously investigate security alerts and generate comprehensive reports. The AI agent space is still emerging, and we expect a wide range of continued innovation across the stack to support new autonomous developments.

4) AI companies continue to secure funding and high valuations at a rapid clip

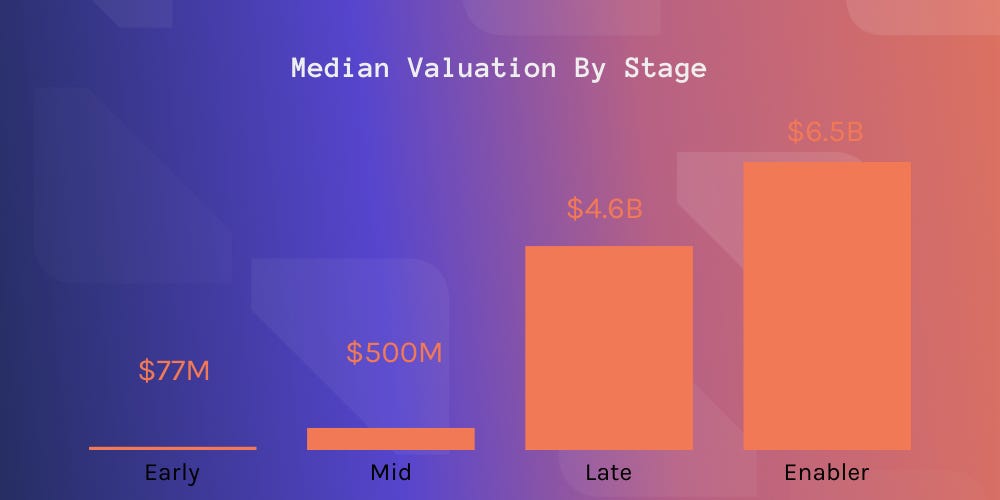

All of the 2024 winners have successfully raised some level of outside capital. Over the past 12 months, 27 of them secured a total of $22.0B in new funding. Enthusiasm in the AI/ML space continues to run hot in recent weeks, with Runway in talks with General Atlantic eyeing a $450M round at a $4B valuation and Harvey reportedly raising $100M at a $1.5B valuation. It is interesting to note these valuations in the context of the broader 2024 IA40 cohort, as these are high but not outside the norm for this year’s late-stage winners. In terms of the median last known valuation, early-stage winners raised at a $77M median valuation, mid-stage at $500M, late-stage at $4.6B, and enablers at $6.5B. Valuations for enablers are generally higher and climbing rapidly at the extremes, with Databricks, OpenAI, Anthropic, and CoreWeave all at around $20B or higher valuations. Most notably, OpenAI is reportedly raising at a valuation of over $100B.

5) Intelligent applications have an increased focus on driving ROI

Intelligent applications are becoming more productivity-oriented across both structured and less structured workflows and data. There is a growing shift in companies helping employees be more productive in how they conduct their work. Several companies on this year’s list aim to solve general productivity for “knowledge workers” throughout an organization by automating daily processes such as meetings (e.g., Read AI, Fireflies.ai). These general productivity applications boast capabilities such as conversation intelligence and workflow automation. They have intuitive UIs that make their tools easy for the average end customer to help boost their productivity from Day 1. Other startup solutions seek to drive productivity within specific functions by empowering teams such as sales (e.g., 11x, Clay, Unify, Rilla). These companies are taking a new approach to an antiquated or complex stack to empower sales teams to do more with less, with tailored integrations or GenAI assistance that enable higher volumes of personalized outreach, enhanced understanding of customer sentiment, and improved deal outcomes. Beyond sales, AI productivity applications are also prevalent for functions such as engineering teams to improve efficiency (e.g., Codium for coding use cases).

Looking Ahead

While we expected some IA40 winners to have gone public by now, this has yet to materialize. However, winners such as Databricks and Hugging Face continue to be active in M&A (e.g., Hugging Face’s strategic acquisition of Xethub). We also anticipate there will continue to be “pseudo-acquisitions” of startups in the AL/ML space as scaled players race to license technology and compete on skilled talent.

While the IA40 list highlights some of the most innovative companies leveraging AI and ML, other high-profile companies such as Sierra, Poolside, and Cognition have raised substantial rounds at eye-popping valuations in 2024 and could be intriguing candidates for making the IA40 next year.

At Madrona, we have spent over a decade partnering with and investing in intelligent application companies, observing their influence and impact across various verticals. These applications are poised to shape the future of software and the next wave of computing. We believe they deserve to be recognized and celebrated for their achievements!

You can read more about the process and methodology here.

Special thanks to our guest author Rolanda Fu for driving the IA40 list and compiling these great insights!