10 Predictions for 2026 🥳

The Year of AI Liquidity?

Last week we put our 2025 AI predictions under the microscope and walked away with a respectable 3.5/5. Not bad, but prediction grading is just the warm-up. The real fun is making the next set, and for 2026 we’re doubling the fun and making ten predictions for the year.

If 2025 was the year AI broke into the mainstream, 2026 is when we see AI generate meaningful dollars, both in terms of product monetization and returns to investors. Markets form opinions. Business models get tested. And some ideas that looked inevitable start to crack.

Without further ado, let’s get to it!

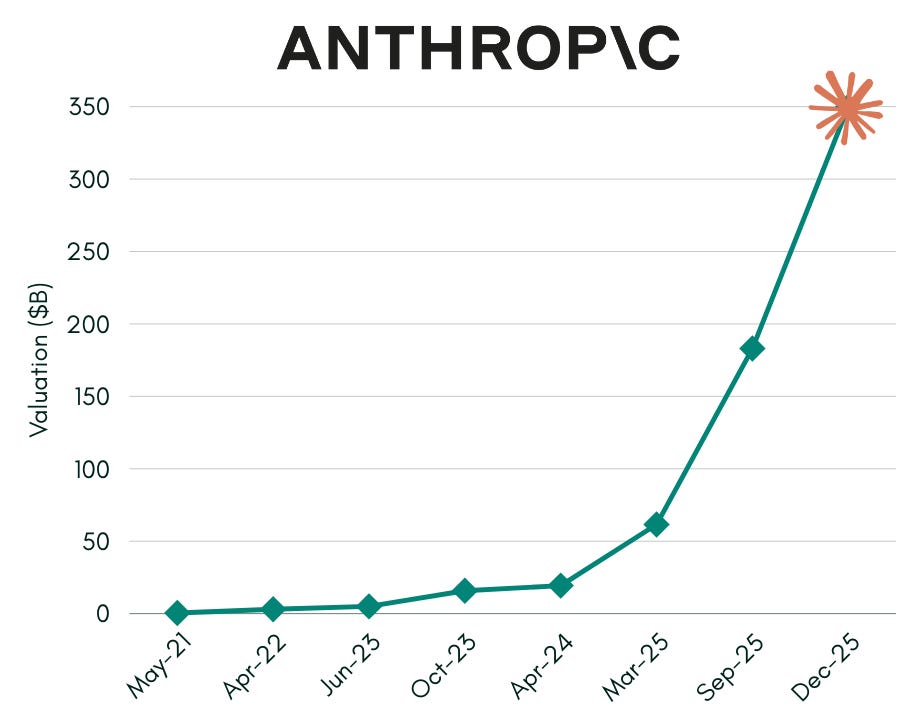

1) Anthropic goes public and hits a $1T market cap

Nothing like kicking things off with a bang!

Anthropic has always been the “little brother” to OpenAI in the AI model space, the Pepsi to OpenAI’s Coca-Cola. But we could see that change in 2026 if Anthropic becomes the first truly AI-native company to hit the public markets. From a valuation perspective Anthropic has been steadily closing the gap between itself and its #1 competitor. At the end of 2024 OpenAI was valued at ~9x Anthropic ($157B vs $18B), but by the close of 2025, that gap is narrowing to ~2x based on Anthropic’s rumored $350B valuation and OpenAI looking to close a round at $830B post.

How has Anthropic done such a great job closing this gap? They’ve become the go-to model choice for enterprises and dominated the coding space. Although Anthropic is still substantially smaller on a revenue basis (~$8-9B run-rate vs. $20B run-rate for OpenAI), they are much more efficient and expect to break even in 2028.

With a fantastic growth story, path to profitability, excellent management, and public investor excitement, Anthropic is not only a great IPO candidate for 2026 but could ride that public market excitement to match, if not surpass, its biggest competitor.

2) Two-tranched rounds surge in H1’26—then fall out of favor just as fast in H2

In Q4’25 we started see more two-tranched fundraises in the private markets: where a company effectively raises two rounds at the same time, one at a lower price where investors commit the lion’s share of their investment, and another round at a 50%-150%+ step up where potentially other investors come in who couldn’t get in the “earlier” round. Why do this? It allows investors to get into a hot round that they otherwise would not be able to, while allowing the company to claim a higher headline valuation.

However, the downsides are obvious: incoming employees start with a higher strike price, the next round may be more difficult to underwrite without continued momentum, cap table incentives are misaligned, LPs can heavily question the second-tranche investors (e.g., “why did you pay 2x the price of another fund for the same asset??”), etc. Some of our peers have also written about this recent phenomenon in, um, colorful terms.

Our view is that two-tranched rounds persist through the first half of 2026. But as public-market valuations normalize, appetite for these structures fades quickly. By the back half of the year, two-tranched fundraises likely join the graveyard of late-cycle financial engineering—discarded alongside the “1000x ARR” deals of the 2021 era.

3) Alphabet (Google) joins the $5T club

OK this one might feel a bit more safe. Alphabet (Google) is already sitting at a $3.8T market cap after a banger 2025 where the stock surged 65%. They “only” need to grow another ~30% to get to $5T. But we believe they are starting to bring all the pieces together to leapfrog Apple and become the second highest valued company in the world behind Nvidia.

Why Nvidia and Google? Nvidia will continue to generate massive revenue from chip demand and incredible moats around its overall ecosystem. Though there are numerous competitors chomping at the bit to take Nvidia down, we may not actually see any adversarial effects until 2027 and beyond.

Google on the other hand has rebounded from being counted out in the AI race to now leading it. Google is starting to fire on all cylinders across the entire stack: silicon, models, apps, and frontier research. Gemini 3 has been lauded with rave reviews and has been outperforming GPT and Claude in several areas. With Sergey Brin “unretiring”, we believe Google is poised for a terrific 2026 and a shot at becoming the most valuable company in the world.

4) Apple makes a large $5B+ acquisition for an AI company

Apple has severely underperformed its Mag7 peers in AI innovation. They have not released any major AI products, its “Apple Intelligence” products have been heavily criticized, and they experienced an extremely rare but major exodus of executive talent in December.

With all of these headwinds, we could see Apple flipping its playbook and making a large, splashy acquisition of a private or public company to try and maintain relevancy in the AI wars. In fact Tim Cook even indicated in Q4 earnings call they would leave the door open to M&A. Apple’s largest acquisition to date was when they bought Beats for $3B in 2014, but we’d expect they’d have to shell out at least $5B (if not closer to $10B) for a worthwhile AI company today.

Who could they target? Perplexity, Mistral, and Cohere come to mind as AI models that are distantly behind OpenAI and Anthropic, but could give Apple a much needed boost in its own AI legitimacy.

5) Adtech sees a resurgence in the AI era

For the past 10+ years in venture and startupland, AdTech has been a dirty word and a dead industry, ultimately won by Google and Meta. But the AI era is reshaping where attention lives and how it’s monetized. As ad dollars flow into new surfaces (AI assistants, vertical AI products, creator tools, and niche networks) the opportunity for a new kind of “adtech for the AI age” is quietly reopening.

The signal is already there. OpenAI is starting to roll out sponsored ads in ChatGPT to offset costs, and AI-native platforms like OpenEvidence sell ads as a core monetization engine. Adobe acquired Semrush for $1.9B in November in part for its generative engine optimization (GEO) products. These aren’t banner ads bolted onto legacy products—they’re integrated, intent-driven placements embedded directly into AI workflows. At the same time, a new generation of martech and adtech startups—companies like Profound, GrowthX, Scrunch and others—are being built specifically for this shift, targeting measurement, distribution, and optimization in AI-native environments.

Could 2026 be the year Adtech finally rebounds from years in purgatory and reemerges for the AI age? We believe so.

6) A mainstream AI consumer platform emerges

In 2026, a breakout AI consumer platform emerges that looks nothing like ChatGPT or today’s productivity tools. This shift is enabled by multimodal models that finally work together (vision, voice, and memory) combined with smartphones and wearables that provide continuous real-world signal. After a wave of “AI for work,” consumers are ready for delight: experiences that feel playful, social, and identity-forming rather than transactional. The first truly mainstream AI product likely won’t be marketed as “AI” as it will feel more like a game, a companion, or a new kind of social platform that uses AI in the background but brings together more social real-life experiences.

7) AI becomes the front door to ambient, personalized healthcare

AI-driven healthcare assistants move from novelty to the default first touch, dramatically expanding access to personalized care outside traditional hospital systems. Patient-facing care has already had its ChatGPT moment. A meaningful share of Americans, especially Gen Z and Millennials, now use ChatGPT for medical advice, signaling clear demand for 24/7, data-driven guidance.

AI begins absorbing what clinicians don’t have time for through persistent health agents that synthesize symptoms, labs, medications, and wearable data before escalating to humans. For many patients, this becomes their first opinion, triage layer, and care coordinator. We’re already seeing momentum from companies like OpenEvidence, Function Health, Amigo, Hippocratic AI, and many more. Models can now reason clinically, healthcare systems face severe labor shortages, and consumer trust in AI is higher than most admit, accelerating a shift from episodic to continuous care.

8) The web and data infrastructure are rebuilt for AI agents

As AI agents begin to create real economic value, it becomes obvious that today’s web is misaligned with how they operate. The internet was designed for humans to read pages, but agents need structured, permissioned, real-time access to data and capabilities. This drives a shift toward agent-native interfaces, where systems expose machine-readable actions instead of brittle webpages or scraped content. Data storage, access, and monetization are reimagined around how agents query, reason, and act and not how humans browse. In an agent-first world, accessibility for machines becomes as important as usability for people.

9) Simulation becomes the testbed for reality

As AI agents gain autonomy, deploying them directly into the real world becomes increasingly risky and expensive. In response, simulation frameworks become the primary testbed for reality. Synthetic environments, policy simulators, and digital twin infrastructure are built to train, stress-test, and evaluate agents before they ever touch production systems. Entire industries like CPG, healthcare, finance, logistics, governance all rely on simulated worlds to understand failure modes and unintended consequences. Over time, reality becomes the deployment layer, not the training ground.

10) AI-native hardware interfaces begin to take shape

Rather than a single breakthrough device, we’ll see steady progress toward AI-native hardware that complements the smartphone and enables more ambient interaction with AI. Early forms emerge across familiar surfaces (e.g., glasses, ear-based devices, and wearables) capturing context through voice, vision, and memory with minimal friction. Improvements in on-device inference allow AI to remain present without feeling intrusive, combining signals across devices to build a more holistic understanding of the individual.

We’ve seen early signals with products like Ray-Ban Meta AI Glasses and the viral Friend pendant. While Friend hasn’t had the best reputation and Meta’s glasses have existed for years, consumer willingness to try new form factors is clear — just compare how many people wear AirPods today versus five years ago. The most successful AI hardware won’t feel disruptive or novel, but like quiet extensions of perception, with subtle form factors such as rings, pins, or pendants emerging over time.

In Conclusion…

As always, predictions are an imperfect exercise. Some of these will age well, others won’t, and a few will likely miss entirely. But, that’s part of the fun. 2026 feels like a year where AI gets pressure-tested in the real world by markets, customers, and actual dollars. We’re excited to watch how it all unfolds and, as always, we’ll be back next year to see how we did. As we look to 2026, we are excited and inspired by what’s to come. Thanks for continuing to support our work and Happy New Year!

Thanks for this list! On - The web and data infrastructure are rebuilt for AI agents - recommend adding Security infrastructure, in particular Data Security to that list.

Every data platform will build data security as a foundational component (and they already are), but customers will also need platform agnostic, multi-layered security in addition to that, and we can expect existing security vendors and startups to pursue that opportunity.

> 8) The web and data infrastructure are rebuilt for AI agents

This falls into the “the web was made for humans” trap, which misses what the web actually is. The web isn’t HTML pages and banner ads, it’s a stack of technologies that together enable a distributed, permissionless, secure, content-agnostic, collaborative ecosystem.

What’s creaky and failing is the HTML + ad-tech business model that grew on top of it. Those companies stopped innovating years ago and optimized themselves into a corner.

An agentic-first perspective is absolutely the right starting point but it doesn’t require rebuilding the web from scratch. It requires finally leveraging the web’s real capabilities instead of forcing everything through human-only interfaces and legacy monetization assumptions.

Done right, agents don’t require a new web, they can finally make full use of the one we already have.